Outsourcing accounting services is a powerful strategy for businesses aiming to streamline operations and boost financial management. Outsourcing accounting processes includes hiring professional accounting services providers who tackle your financial needs, from basic to complex accounting tasks as well as specialized services like budgeting, financial planning and analysis, etc.

However, to truly reap these rewards, it’s not enough to just hand over tasks. A strategic approach is vital. This means:

- Clearly defining your business needs

- Researching and choosing reputable providers

- Setting up clear communication and performance standards

In this blog on how to outsource accounting services, we’ll explore how a well-thought-out step-by-step approach can optimize your financial processes and drive overall business growth and success. Let’s dive into the transformative benefits and the essential steps for fully leveraging outsourcing for your business.

Benefits of Outsourcing Accounting

- Reduced Overhead: Outsourcing accounting services typically results in lower overhead costs compared to hiring and maintaining an in-house accounting team. You can avoid expenses such as salaries, benefits, office space, and equipment.

- Qualified Professionals: Gain access to qualified accounting professionals, such as CPAs and experienced bookkeepers, without the need for recruitment or training expenses. This ensures that your financial tasks are handled by experts who adhere to industry standards and regulations.

- Focus on Core Activities: By outsourcing accounting tasks, you can redirect your focus and resources towards core business activities. This enhances overall efficiency and productivity, allowing you and your team to concentrate on strategic initiatives and growth opportunities.

- Adjusting Services: Outsourcing offers flexibility to scale accounting services up or down as your business evolves. Whether you need to expand services during busy periods or adjust service levels during slower times, outsourcing allows you to adapt quickly without the constraints of hiring or downsizing internal staff.

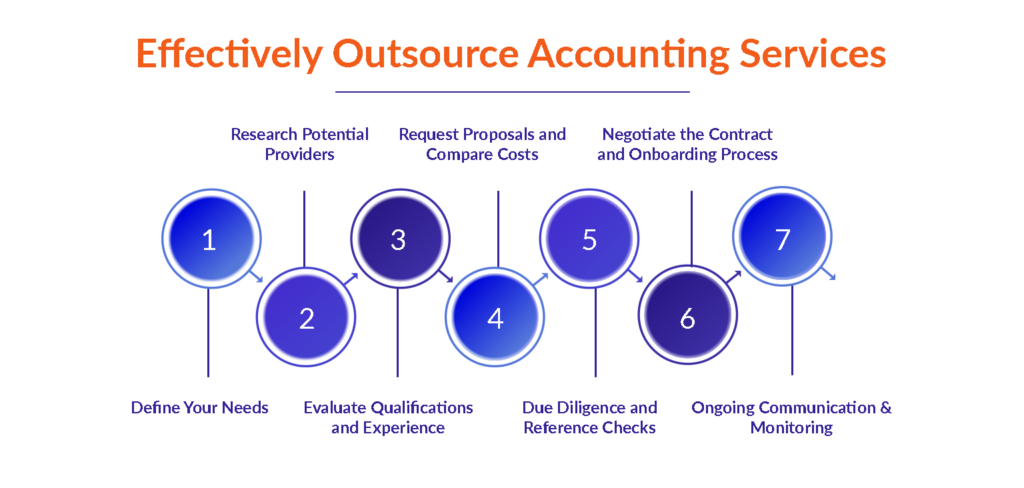

Key Steps to Effectively Outsource Your Accounting Needs

Here is a structured approach to “How to Outsource Accounting Services“, covering assessment of requirements, selection of providers, contract negotiation, communication setup, performance monitoring, and continuous improvement.

Step 1: Define Your Needs

Current Pain Points:

- Identifying Manual Processes: Look at your current accounting methods. Are you spending too much time on manual data entry and paperwork? This can be a major efficiency drain.

- Time Constraints: Consider how much time you or your team are spending on accounting tasks. If these tasks are taking you away from focusing on growing your business, it’s a clear sign that you need help.

- Lack of Expertise: Be honest about your team’s skill set. Are there aspects of accounting, such as tax laws or financial analysis, where you lack expertise? Recognizing this gap is crucial to finding the right support.

Desired Services:

- Bookkeeping: This involves keeping your financial records organized and up to date. It’s the foundation of your financial health.

- Payroll: Managing payroll can be time-consuming and complex. Outsourcing accounts payable ensures your employees are paid accurately and on time, complying with all regulations.

- Tax Preparation: Handling taxes can be daunting. Outsourcing this service helps you stay compliant with tax laws, reduces the risk of errors, and can even minimize your tax liabilities.

- Financial Reporting: Regular, accurate financial reports provide insights into your business’s performance, helping you make informed decisions.

Step 2: Research Potential Providers

1. Online Directories:

Platforms like Clutch and Upwork: Platforms like Clutch and Upwork list many accounting service providers with reviews and ratings. Clutch offers detailed company profiles and client reviews for a comprehensive view. Upwork lets you browse profiles, check ratings, and read client feedback. This helps you assess each provider’s credibility and expertise before contacting them.

2. Industry Associations:

Recommendations from Industry Associations: Many industries have associations that offer resources and recommendations for outsourcing services like AcoBloom International. These associations can provide a list of vetted accounting service providers who have experience in your specific industry. This ensures that the providers understand the unique financial requirements and regulations relevant to your business.

3. Word-of-Mouth:

Referrals from Trusted Colleagues or Business Partners: Reach out to your network for recommendations. Colleagues and business partners who have successfully outsourced their accounting services can provide valuable insights and firsthand experiences.

They can highlight providers who deliver quality service, communicate effectively, and align with your business values. Personal referrals often come with honest feedback about the provider’s strengths and areas for improvement, helping you make a well-rounded decision.

Step 3: Evaluate Qualifications and Experience

1. Credentials and Expertise:

Importance of Qualified Professionals: Look for providers with certified professionals such as CPAs (Certified Public Accountants) and experienced bookkeepers. These qualifications ensure that the individuals handling your finances have the necessary expertise and adhere to professional standards.

2. Technology and Automation:

Leveraging Technology and Automation: Evaluate how potential providers utilize technology and automation tools. Efficient use of software for accounting processes not only improves accuracy but also enhances security and speeds up tasks like data entry and reporting. This capability is crucial for maintaining up-to-date and error-free financial records.

3. Communication Style and Time Zones:

Ensuring Smooth Collaboration: Consider the provider’s communication style and time zone compatibility. Effective collaboration relies on clear communication channels that match your preferences—whether through regular video calls, emails, or project management tools. Additionally, aligning time zones ensures timely responses and minimizes delays in resolving queries or issues.

Step 4: Request Proposals and Compare Costs

1. RFP (Request for Proposal):

Developing an RFP: Create a detailed Request for Proposal (RFP) outlining your specific needs, desired services, and budget expectations. Clearly state your requirements for bookkeeping, payroll, tax preparation, and financial reporting. This document helps potential providers understand your expectations and enables you to receive tailored proposals.

2. Compare Proposals:

Evaluating Proposals: Review and compare the proposals you receive based on several criteria:

- Cost: Compare pricing structures to ensure they fit within your budget constraints.

- Qualifications and Experience: Assess the provider’s credentials, such as certifications and relevant industry experience.

- Service Offerings: Evaluate the scope of services offered to ensure they meet your current and future needs.

3. Ask Clarifying Questions:

Ensuring Alignment: Seek clarification on any aspects of the proposals that are unclear or require further explanation. Address concerns related to service delivery, communication protocols, and responsiveness to ensure the selected provider aligns with your business requirements and values.

Step 5: Due Diligence and Reference Checks

1. Background Checks:

Verifying Credentials and Reputation: Conduct thorough background checks on the shortlisted providers. Verify their credentials, such as certifications and licenses, to ensure they meet industry standards and regulatory requirements. Additionally, research their reputation by reviewing client testimonials, online reviews, and any disciplinary actions or complaints.

2. Reference Checks:

Insights from References: Contact references provided by the providers to gain insights into their service quality and client satisfaction. Ask specific questions about the provider’s reliability, responsiveness, accuracy of financial reporting, adherence to deadlines, and overall professionalism. References can provide valuable firsthand experiences that help validate the provider’s capabilities and compatibility with your business needs.

Step 6: Negotiate the Contract and Onboarding Process

1. Clear Service Level Agreement (SLA):

Outlining Services: Define the scope of services clearly in the Service Level Agreement (SLA). Include details on bookkeeping, payroll, tax preparation, and financial reporting, specifying turnaround times, quality standards, and communication protocols. Outline termination clauses to clarify the conditions under which the contract can be terminated by either party.

2. Data Security Measures:

Ensuring Robust Data Security: Prioritize data security by discussing and confirming the provider’s measures to protect sensitive financial information. Ensure they comply with industry standards and regulations. Address concerns regarding data encryption, access controls, backups, and procedures for handling data breaches.

3. Onboarding Process:

- Discussing Data Migration: Outline the data migration process from your current accounting system to the provider’s platform. Discuss timelines, data integrity checks, and responsibilities for transferring financial records securely.

- Team Training on New Accounting Software: Plan for training sessions to familiarize your team with any new accounting software or tools introduced by the provider. Ensure your team understands how to use the software effectively for day-to-day operations and reporting requirements.

Step 7: Ongoing Communication and Monitoring

1. Regular Meetings:

Scheduling Meetings: Set up regular meetings with your outsourced accounting provider to review progress and ensure alignment with your business goals. These meetings are crucial for discussing ongoing tasks, addressing any issues, and planning for upcoming financial activities.

2. Performance Tracking:

Establishing KPIs: Define Key Performance Indicators (KPIs) to measure the effectiveness of the outsourced services. These metrics could include accuracy of financial reports, timeliness of payroll processing, compliance with tax deadlines, and client satisfaction ratings. Regularly monitor these KPIs to evaluate the provider’s performance and identify areas for improvement.

3. Open Communication:

Maintaining Channels: Maintain open channels of communication to address concerns or emerging needs promptly. Encourage feedback from both parties to foster a collaborative relationship and ensure that any issues are addressed proactively. Clear communication helps in resolving issues quickly and maintaining a productive partnership over time.

Conclusion

In conclusion, successfully outsourcing your accounting services involves a strategic approach that can significantly benefit your business in various ways. By following these steps:

- Define Your Needs: Identify pain points and desired services.

- Research Potential Providers: Utilize directories, industry associations, and referrals.

- Evaluate Qualifications and Experience: Consider credentials, technology use, and communication compatibility.

- Request Proposals and Compare Costs: Develop an RFP, evaluate proposals, and ask clarifying questions.

- Due Diligence and Reference Checks: Verify credentials and gather insights from references.

- Negotiate the Contract and Onboarding Process: Establish clear SLAs, discuss data security, and plan the onboarding process.

- Ongoing Communication and Monitoring: Schedule regular meetings, track performance with KPIs, and maintain open communication channels.

You can achieve significant benefits:

Outsourcing offers cost savings by reducing overhead, provides access to expert professionals without recruitment costs, improves efficiency by allowing you to focus on core activities, and offers scalability to adjust services as your business grows or needs change.

By embracing outsourcing as a strategic tool, you empower your business to grow efficiently and focus on innovation and customer satisfaction. Consider outsourcing as a pivotal step towards achieving long-term success and sustainability in today’s competitive business landscape.