Can one accounting firm be better than another? And if that were indeed true, what would be the criteria for measuring the performance of one firm against another? Traditionally, most firms had to adhere to a rules-based approach, where performance was linked to internal quality management parameters. The greater adherence to quality standards, the better the outcome. The formula, in a sense, was simple.

However, with the advent of outsourcing and the growing shortage of CPAs that has inadvertently fueled the rise of foreign outsourcing hubs; creating a distinction between one outsourcing jurisdiction over the other is a relatively more complicated process. Other than massive cost saving, factors such as data security, the reliability and qualifications of the outsourcing partner, cultural compatibility, technological maturity, and the ability to comply with global accounting standards all play a role.

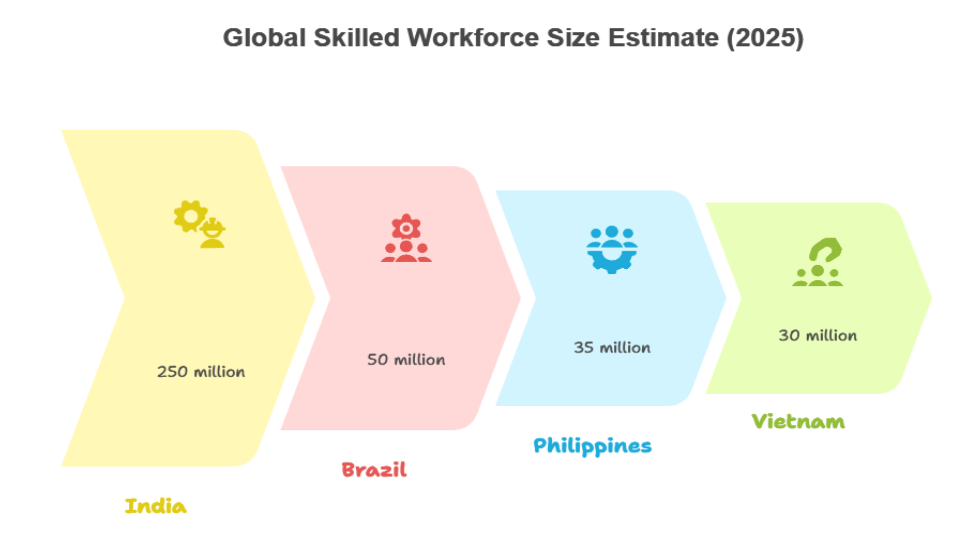

Over the years, India has consistently been a top destination for outsourcing. The heavy reliance of the country’s service sector has led to development on various fronts – government reforms, a focus on quality education, and cultural and economic shifts, to name just a few. While India’s dominance has remained strong over the last two decades, other emerging nations have turned into strong contenders. Countries like the Philippines and Malaysia are counted among the top offshore destinations for specific services.

This blog explores why India still stands a cut above when compared to other outsourcing jurisdictions, especially when it comes to finance and accounting.

Factors that make India an Outsourcing Superpower

A Very Large and Versatile Talent Pool

India’s biggest strength lies in the sheer volume of qualified professionals. The Institute of Chartered Accountants of India (ICAI), the second-largest professional accounting body in the world after the AICPA, reported in its 2025 Student and Member Report that there are 1,006,256 active student registrations across all levels of the Chartered Accountancy programme. This includes 347,256 Foundation, 417,609 Intermediate, and 241,391 Final-level students.

During the Final examination session held in May 2025, 29,286 candidates appeared, and 5,490 successfully qualified as Chartered Accountants, reflecting a pass rate of 18.75%. Earlier, in the January 2025 Foundation session, 110,887 candidates appeared, of which 23,861 passed, yielding a pass rate of 21.52%. These statistics, published by ICAI, highlight the depth and rigor of India’s accounting education framework.

Each year, more than 100,000 candidates progress through the multi-level CA examination system, maintaining India’s globally recognised standards in auditing, taxation, and financial management. Alongside the domestic CA qualification, a growing number of Indian professionals pursue international credentials such as the Association of Chartered Certified Accountants (ACCA) and the U.S. Certified Public Accountant.

This laborious and merit-based qualification system has created one of the largest and most stable pools of accounting and finance professionals in the world. Backed by statutory regulation, strong ethical standards, and globally aligned curricula, India’s accounting workforce continues to grow year after year, replenished by hundreds of thousands of new entrants pursuing Chartered Accountancy, ACCA, and CPA qualifications.

In contrast, Brazil’s accounting workforce, while well-established and professionally regulated, is considerably smaller in scale compared to India’s. According to official data from the Federal Accounting Council (CFC) as of September 30, 2025, Brazil has a total of 538,539 active accounting professionals. The State of São Paulo accounts for 152,393 registered accountants, representing 28% of the national total, and hosts 29,050 accounting firms out of Brazil’s 100,727 registered entities.

When compared to India’s over one million active CA students and hundreds of thousands of qualified professionals, Brazil’s accounting sector operates on a much narrower base of human capital. This stark difference highlights India’s distinct advantage in talent availability, scalability, and long-term capacity to support global finance and accounting services.

High Quality Service with Competitive Costs

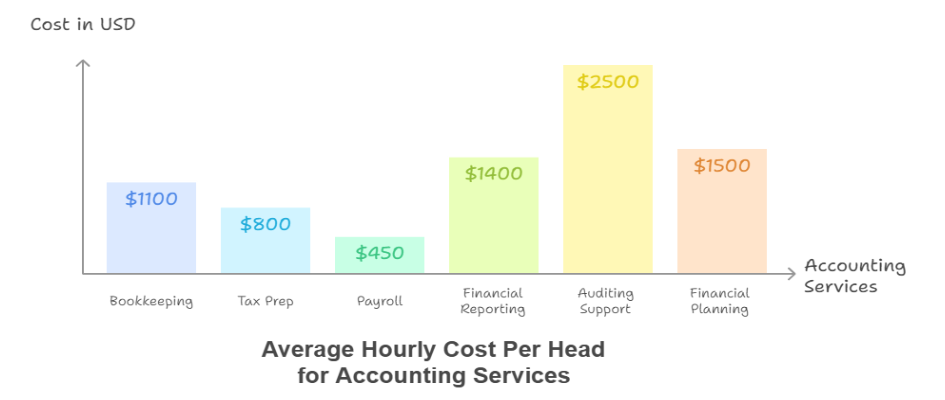

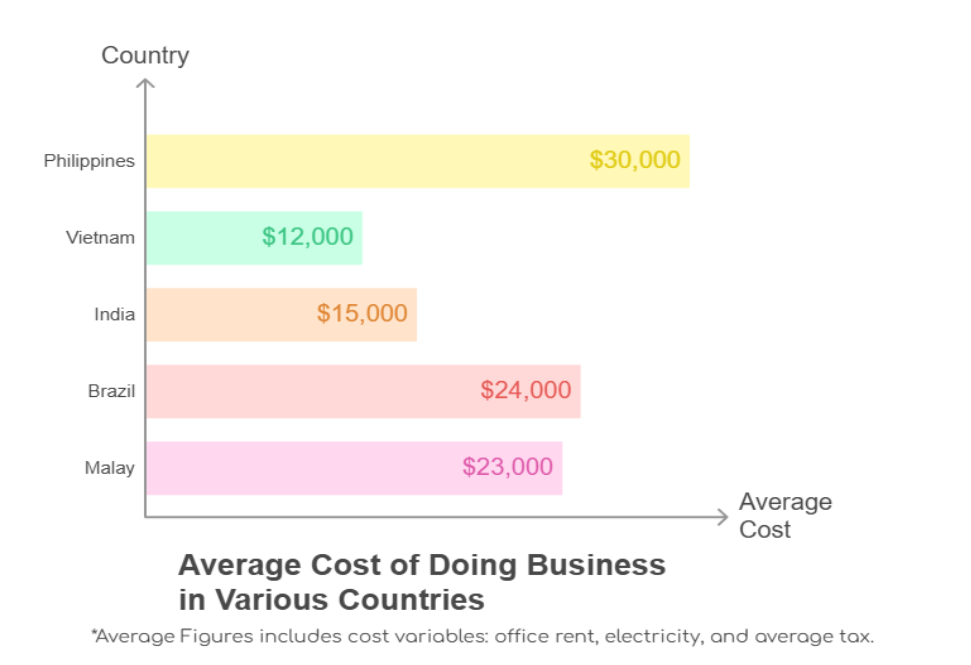

One of India’s biggest advantages in financial and accounting outsourcing lies in its cost efficiency combined with high service quality. Supported by a mature outsourcing ecosystem and competitive operating costs, India enables foreign accounting firms to achieve high levels of cost savings compared to hiring in-house or outsourcing to Western markets.

According to industry sources and our own internal research, the average cost of outsourcing financial and accounting services to India varies based on the complexity of work, skill level required, and service tier (SME vs. Enterprise).

The closest competitor to India’s cost advantage is the Philippines, which offers lower base rates ranging from $4 to $25 for transactional accounting tasks such as bookkeeping, payroll, and accounts payable/receivable processing. However, while the Philippines provides cheaper costs, India maintains a strategic edge in terms of technical depth, scalability, and end-to-end financial expertise.

Ease of Communication and Language Proficiency

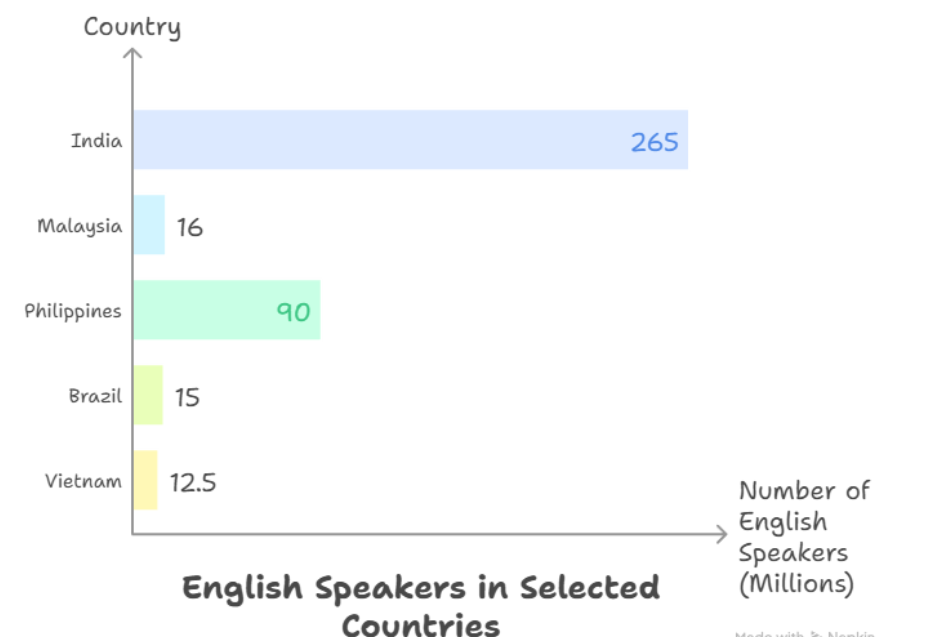

India’s dominance in global business is partly due to its strong English skills, enabling smooth communication, client engagement, and collaboration worldwide. It has the second-largest English-speaking population after the US, owing to a long history of English-medium education integrated into commerce, law, and professional fields.

Indian business practices closely mirror Western styles, especially those of the US and UK, with professionals familiar with global norms like structured communication, deadline-driven project management, and compliance standards.

Through outsourcing collaborations, Indian companies have built workflows, reporting, and service models aligned with Western organizational practices, facilitating easy integration with international teams.

The Philippines continues to rival India in English proficiency, ranking among the top two countries in Asia and the top 20 globally, according to the EF English Proficiency Index (2024). The country has a workforce known for its clear communication, neutral accents, and strong cultural alignment with Western clients. However, while the Philippines excels in language fluency and customer interaction, it lacks the depth of technical and financial vocabulary found among India’s accounting and finance professionals, whose English training is closely tied to commerce and professional qualifications.

Malaysia also ranks highly in English proficiency, placing itself among the top three countries in Asia according to the EF English Proficiency Index (2024). Yet, Malaysia’s English-speaking workforce is smaller and more regionally concentrated than India’s. In contrast, India’s vast, English-educated professional base spanning millions of finance and accounting specialists provides a broader and more scalable communication advantage for global outsourcing operations.

Business-Friendly Environment and Government Support

India’s regulatory environment for accounting and finance services is built on a strong statutory foundation and actively supported by government policy. The Institute of Chartered Accountants of India (ICAI) operates under the Chartered Accountants Act, 1949, administered by the Ministry of Corporate Affairs (MCA), which ensures uniform professional standards, continuous education, and strict disciplinary oversight for members.

The MCA also supervises the Institute of Cost Accountants of India (ICMAI) and the Institute of Company Secretaries of India (ICSI), together forming a comprehensive regulatory ecosystem governing all major areas of corporate finance, audit, and governance.

India’s government actively supports outsourcing through Special Economic Zones (SEZs), tax incentives, and digital-skill development initiatives. The SEZs, regulated under the Special Economic Zones Act, 2005, and overseen by the Department of Commerce, offer fiscal benefits such as income tax exemptions, duty-free imports, and simplified compliance processes, making them attractive for global outsourcing and shared service operations.

Additionally, the Digital Personal Data Protection Act (2023) enhances data security standards for global clients by aligning India’s privacy and data-handling norms with international frameworks.

Most major outsourcing providers in India now comply with ISO 27001, SOC 2, and GDPR-equivalent data protection measures, giving international accounting and audit firms strong confidence in India’s data governance practices. These standards, reinforced by government policy, ensure secure and compliant handling of confidential financial information, a decisive factor in outsourcing decisions.

An equally supportive regulatory system can be found in the Philippines, with its Ease of Doing Business and Efficient Government Service Delivery Act (RA 11032) and the Anti-Red Tape Authority (ARTA), to strengthen the business environment and lower administrative burdens for businesses. Also, the Data Privacy Act of 2012 (RA 10173) sets strict standards for handling personal and financial data, ensuring compliance with international norms and safeguarding sensitive client information, which is critical for accounting and finance outsourcing.

Market Favourability and Positive Outlook

India’s accounting and audit outsourcing sector continues to show a strong and sustained upward trajectory. Over the past several years, the volume of outsourced financial services to India has grown steadily, supported by the country’s expanding professional workforce, digital transformation in business processes, and continued government support for the export of services.

The trend indicates an increase in international confidence in India’s outsourcing capabilities but also a structural shift toward more high-value and technology-driven services such as audit analytics, financial planning, and compliance automation. As global firms seek cost-efficient yet reliable partners, India remains the destination of choice, combining scale, skill, and strategic expertise to deliver integrated financial solutions.

Driven by demand from North America, Europe, and the Asia-Pacific region, India’s market outlook remains robust, with consistent double-digit annual growth projections across finance and accounting outsourcing segments. The sector is further bolstered by advances in AI-enabled automation, cloud accounting, and data analytics, positioning India as not just a cost leader, but a strategic hub for innovation and transformation in global financial services.

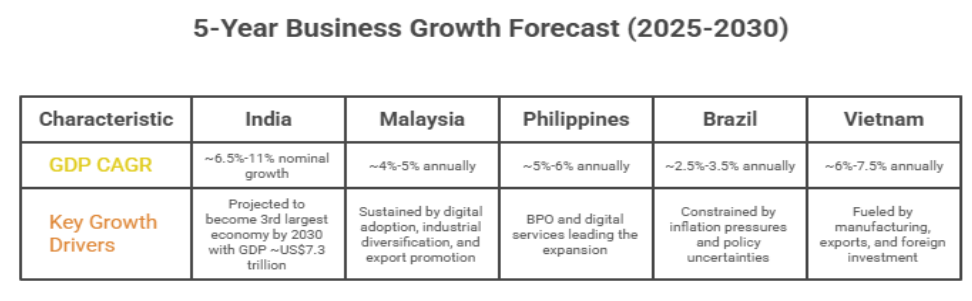

The Philippines, Malaysia, and Brazil are also close competitors to India, with the Philippines’ annual growth expected to be 5-7% through 2030, while Malaysia’s finance and accounting sector grows steadily due to digitalization, stability, and policy support, with services comprising over 58% of GDP and investments in GBS.

Strong Outsourcing Presence and Global Adoption

India dominates outsourcing, with over 90% of Fortune 500 companies, including “Big Four’ firms (Deloitte, PwC, EY, KPMG), having offshore or shared centers handling audit, financial reporting, tax, and analytics. Mid-sized U.S. CPA firms increasingly outsource to India for cost, scalability, and accuracy. Firms from the UK, Canada, and Australia also partner long-term with Indian providers, integrating them into their workflows.

The Philippines competes closely, particularly in accounting outsourcing, with strong market growth (up to 12.8% CAGR), estimated BPO revenues of $38 billion in 2024, and government support focused on technology adoption and workforce development. However, while growing rapidly, its overall market size and scale are still smaller than India’s and are more focused on BPO segments with a strong emphasis on English fluency and cost.

Malaysia offers a mature and regulated market with a focus on specific niches, including regional clients from Japan and Australia, and specialties like Islamic finance reporting. Growth is steady but smaller in scale and slower compared to India and the Philippines. The market benefits from government incentives but lacks the deep ecosystem and client penetration India has.

Brazil shows steady but slower growth in accounting outsourcing, hampered by regulatory complexity, language barriers, and auditing requirements. The country serves Latin American near-shore needs, but does not match the scale, technology adoption, or global client base that India has achieved.

Conclusion

In an increasingly globalized and competitive accounting landscape, the question is no longer whether firms should outsource; but where can they find the most reliable, scalable, and future-ready partner. On every meaningful parameter—talent depth, cost efficiency, communication proficiency, regulatory maturity, technological advancement, and long-term market stability; India continues to stand unmistakably ahead of other outsourcing jurisdictions.

While nations like the Philippines, Malaysia, and Brazil have carved out respectable niches, none match the scale, sophistication, or long-term growth capacity that India offers. With over 90% of Fortune 500 companies already leveraging Indian offshore capabilities, and mid-market CPA firms increasingly integrating Indian teams into their core service delivery, India continues to solidify its position as the world’s most trusted and strategically advanced destination for finance and accounting outsourcing.

As the global demand for skilled accounting talent intensifies and firms seek partners who can deliver accuracy, efficiency, security, and innovation, India’s dominance is set not just to continue—but to grow even stronger. Whether for cost optimization, operational resilience, or digital transformation, India remains the strategic choice for accounting firms worldwide looking to scale with confidence and compete at the highest level.