Audit related penalties are on the rise. As part of the Government’s cleanup initiative, new SEC Chairman Paul S. Atkins, termed misses as “serious failures”. In the fourth quarter of 2024 alone, the Public Company Accounting Oversight Board (PCAOB) imposed the highest number of fines to audit firms and individuals, bringing total penalties for 2024 to an astounding $37.4 million.

These record numbers are a stark reminder that audit quality isn’t just about compliance, it’s about protecting stakeholders and maintaining market confidence.

At the heart of quality audits lies a fundamental understanding of the need for timely and accurate audits. A study by The Center of Audit Quality found that 2 out of every 5 audit firms missed standard quality parameters as defined by the PCAOB. This essentially boiled down to how audit professionals perceived quality standards, which was, as the study found, subjective in many cases.

Other studies found that the need for a clear distinction between internal and external audits is ever present. While both types of audits are vital in their own way, they serve very distinct purposes. Knowing when to leverage one over the other can mean the difference between meeting regulatory compliance and a regulatory catastrophe.

What is an Internal Audit?

Internal audit is the process within a firm that provides an unbiased and independent review of the accounting processes and internal controls related to accounting. Internal auditors are employees of your firm who provide assurance and consulting to add value in the firm’s accounting operations.

They report directly to the firm’s Board of Directors’ Audit Committee. This structure is crucial as it preserves independence from daily accounting activities. Furthermore, internal audit services enable your firm to help clients meet regulatory requirements, improve operational performance, and strengthen governance structures.

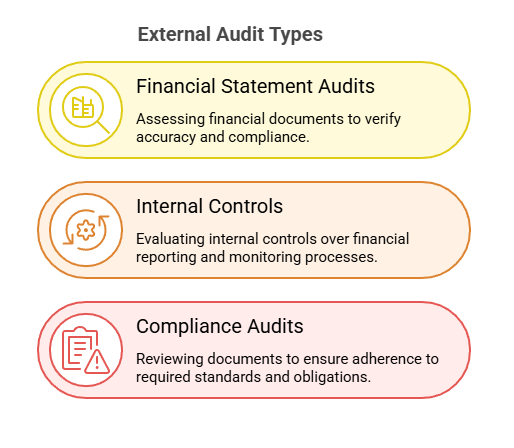

What is an External Audit?

External audit, on the other hand, is an independent review of your organization’s financial statements carried out by certified public accountants (CPAs) who have no ties to your company. These auditors are from external accounting firms and offer an independent, third-party opinion on whether your financial statements accurately reflect your company’s financial position.

External auditors adhere to strict professional standards and are closely monitored by regulatory agencies. External audits are often scheduled annually to comply with regulatory requirements and deadlines.

The external audit process is more formal and standardized than the internal audit. External auditors must adhere to relevant accounting standards and ISAs and are required to maintain complete independence from your organization.

Note: They are restricted from offering certain non-audit services to preserve their independence, prioritizing their main role of providing an opinion on the accuracy and compliance of your financial statements with accounting standards.

What is the difference between Internal and External Audit?

Internal and external audits both seeks to provide an opinion about a company’s finances and operations. However, they seem different when it comes to performing an audit concerning the scope of the company. Here are the significant differences between internal and external audits:

1. Purpose

The fundamental difference between internal and external audit lies in their purpose. Internal audit is designed to help your organization improve. It’s proactive, focusing on identifying risks and opportunities for enhancement across all business areas.

External audit, on the other hand, aims to offer assurance. It is a reactive process focused on verifying the accuracy and compliance of your financial statements with applicable accounting standards.

2. Reporting Structure

Internal auditors report to your organization’s audit committee, which consists of independent board members. This structure ensures they can investigate sensitive issues without fear of retaliation while maintaining their independence from management. The audit committee reviews internal audit findings and ensures management takes appropriate action.

External auditors report to your shareholders and stakeholders. Their opinions become part of the public record for publicly traded companies, and they’re legally liable for their professional opinions. This external reporting shifts the focus toward public accountability instead of internal improvement.

3. Scope and Timing

Internal auditors continuously evaluate the effectiveness of internal controls and risk management processes to ensure the prompt identification and correction of control weaknesses. They have continuous access to your organization and can conduct audits throughout the year, allowing them to identify and address issues in real-time.

External auditors work on a cyclical basis, typically conducting annual audits with specific deadlines. Their scope is primarily limited to financial statement audits, although they may also perform attestation services for internal controls over financial reporting.

4. Independence

Both types of auditors must maintain independence, but they achieve this in different ways. Internal auditors maintain organizational independence by reporting to the audit committee rather than management. However, they’re still employees of the organization, which can create subtle pressures and limitations.

External auditors maintain complete independence from your organization. They cannot have financial interests in your company, cannot provide certain non-audit services, and must rotate key personnel regularly to prevent relationships that might compromise their objectivity.

5. Cost and Resource

Depending on the scope, objectives, and stakeholder requirements, the cost and resources needed for both internal and external resources vary.

Internal audits aim to maximize value and minimize costs to improve organizational effectiveness and efficiency. Internal auditors focus on allocating resources to high-risk areas and ensuring comprehensive coverage of operations.

Meanwhile, external audits involve budgeting for complex costs to meet regulatory requirements and build stakeholder trust. The fees for external audits can fluctuate depending on the complexity of the organization’s operations, industry regulations, and the scope of services requested.

Conclusion

Understanding the distinction between internal and external audits is crucial for an organization’s long-term success, growth, and visibility. As audit penalties reach new highs and regulatory oversight becomes stricter, it’s not a question of whether investing in quality audit functions is affordable, but whether neglecting them is an option. Organizations that effectively understand and utilize both internal and external audits will be better positioned to manage risks, stay compliant, and foster trust.

It’s essential to see internal and external audits not as competing efforts but as complementary elements within a comprehensive governance system. When well-implemented and coordinated, they offer the oversight, assurance, and ongoing improvement necessary for organizations to thrive amid increasing complexity in the business landscape.