Navigating compliance as a recipient of federal funding is no small task. For U.S. businesses, especially those that receive grants or assistance from federal agencies, undergoing a single audit is not just a formality—it’s a critical requirement to maintain eligibility and uphold accountability. This single audit guide offers a detailed breakdown of everything CPA firms needs to know, from audit fundamentals to advising preparation strategies to Business, and how audit support outsourcing can make the entire process more efficient and less stressful.

What is a Single Audit?

A single audit, formerly known as the OMB Circular A-133 audit, is a detailed review of how organizations manage federal funds. It is typically required for entities that expend $750,000 or more in federal awards during a fiscal year. This audit goes beyond typical financial statement reviews by also assessing compliance with specific federal regulations, statutes, and award terms.

It ensures compliance with the Uniform Guidance (2 CFR Part 200) and focuses on both financial statements and federal award management. Initiated under OMB’s Uniform Guidance (2 CFR Part 200, Subpart F), a single audit is designed to:

- Determine if federal funds were used properly,

- Identify internal control weaknesses,

- Evaluate compliance with federal program rules,

- Report findings to the Federal Audit Clearinghouse (FAC).

While originally developed for government and nonprofit sectors, many U.S. businesses, especially those in R&D, infrastructure, health, or education, now regularly receive federal assistance and thus fall within the scope of the audit.

Get the Full Guide: Single & Yellow Book Audit Whitepaper

Download NowWhy Single Audits Matter in 2025

With over $1.2 trillion in federal funds disbursed through grants, relief packages, and development programs, the U.S. government continues to ensure that recipients are accountable. In 2025, federal agencies have tightened oversight mechanisms to ensure funds are spent according to federal regulations.

Failing to pass a single audit or addressing findings inadequately can lead to:

- Withheld future funding,

- Repayment of funds,

- Public disclosure of audit findings,

- Legal consequences in severe cases.

For businesses seeking to expand through government-funded projects or partnerships, a clean audit report is a signal of strong compliance and credibility.

Who is Subject to a Single Audit?

Under the Uniform Guidance, your organization must undergo a single audit if:

- Businesses expend (not just receive) $750,000 or more in federal awards in a fiscal year,

- Funds come directly from federal agencies or through a pass-through entity (e.g., state or local governments).

This includes:

- Private businesses contracting with the federal government,

- Research firms funded through NIH or NSF grants,

- Construction and infrastructure companies handling federally supported projects,

- Healthcare organizations receiving HHS funding,

- Educational and training providers involved in workforce development programs.

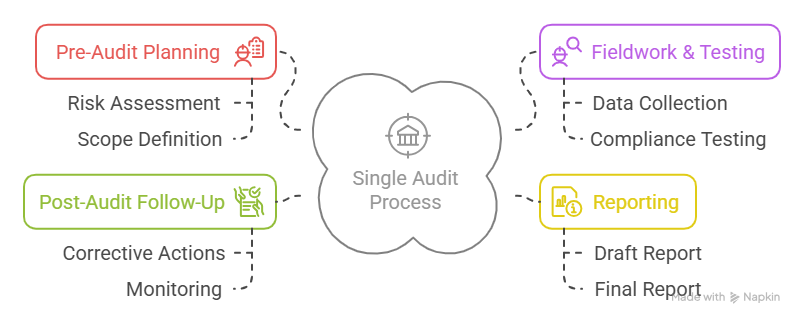

The Single Audit Process: Step-by-Step

Understanding the full lifecycle of a single audit can help CPA firms to conduct such audits effectively and efficiently.

1. Pre-Audit Planning

This phase involves:

- Assembling all federal award documentation,

- Reviewing grant agreements,

- Evaluating internal controls and compliance processes,

2. Fieldwork & Testing

Auditors should assess:

- Organization’s financial statements,

- Internal control systems over federal funds,

- Compliance with program-specific requirements (e.g., cost allowability, procurement, time and effort reporting),

- Sample transactions related to grants.

This phase may include interviews, walkthroughs, and document sampling.

3. Reporting

The auditor prepares a Single Audit Report, which includes:

- Financial statements,

- Schedule of expenditures of federal awards (SEFA),

- Auditor’s opinion on compliance,

- Schedule of findings and questioned costs (if any),

- Management responses and corrective actions.

The final report must be submitted to the Federal Audit Clearinghouse within 30 days of receipt or 9 months after the fiscal year-end, whichever is earlier.

4. Post-Audit Follow-Up

If there are findings:

- Client must submit a Corrective Action Plan (CAP),

- Implement control or policy changes,

- Monitor corrective action progress for future compliance.

Common Single Audit Findings in 2025

Based on recent reports, businesses often struggle with:

- Lack of documented policies around procurement, subrecipient monitoring, and cost allocation,

- Weak or missing internal controls over grant transactions,

- Improper time and effort reporting for staff funded by federal grants,

- Late or inaccurate SEFA reporting,

- Inadequate response to prior audit findings.

These findings can jeopardize future funding and raise red flags for oversight bodies. Preventing these issues requires planning.

Why U.S. CPA firms Are Turning to Audit Support Outsourcing in 2025

As compliance requirements grow more complex and audit resources stay limited, audit support outsourcing is becoming increasingly popular. It involves hiring Audit support outsourcing companies such as AcoBloom to manage key aspects of audit preparation and support.

How AcoBloom Supports Single Audits

At AcoBloom International, we partner with CPA firms across the United States to deliver scalable and high-quality Audit Co-Sourcing Services, designed specifically to meet the rigorous demands of Single Audits.

With a seasoned team of audit professionals, AcoBloom integrates seamlessly with your internal teams to provide end-to-end support that includes:

- Specialized Support for Federal Audits

We assist in all phases of Single Audit engagements—covering sampling, internal control evaluations, test of controls, and compliance documentation. - Accurate & Compliant Documentation

Our team prepares detailed workpapers, lead schedules, and compliance checklists that adhere to federal standards, including the Uniform Guidance (2 CFR Part 200). - Grant-Specific Audit Procedures

From expenditure testing to internal control assessments, we ensure a thorough understanding and execution of grant compliance requirements. - Peak Season Flexibility

We help CPA firms manage busy seasons by expanding audit capacity without adding fixed overhead—maintaining quality and deadlines with ease. - Consistent, Cost-Effective Delivery

Our co-sourcing model provides CPA firms with reliable, high-quality outputs at competitive costs, improving efficiency and reducing turnaround time.

By choosing AcoBloom, CPA firms gain a dependable audit partner capable of enhancing internal capabilities, ensuring regulatory compliance, and maintaining the highest standards of audit excellence.