Introduction

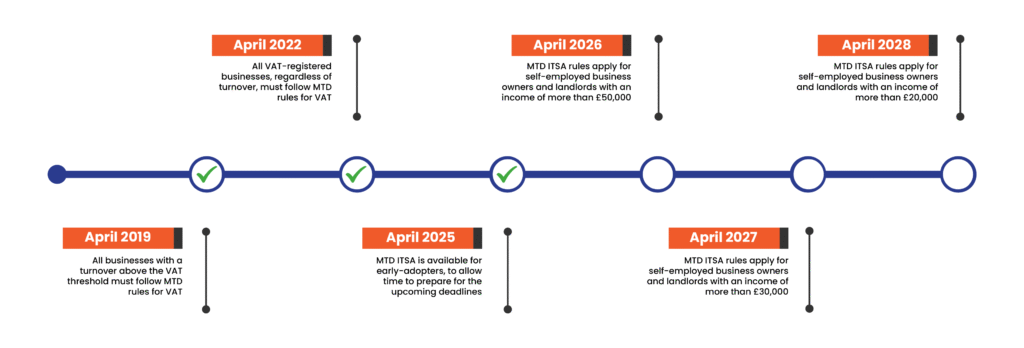

Going forward, all sole traders and landlords in the UK will have to be on their toes. HMRC is rolling out its most significant changes i.e., Making Tax Digital for Income Tax Self-Assessment from April 2026. The move is aimed at bringing sole traders and landlords under the purview of the digital income tax system.

While this is significant for sole traders and landlords, accountants who are servicing clients in these categories will need to adapt to this crucial shift in how data and tax reporting are handled. It involves implementing digital systems for continuous, precise reporting. Firms that prepare in advance are going to minimize compliance risks and build trust by providing clients with a clearer view of their tax situation throughout the year.

This blog dives into the details of this policy, how HMRC plans to execute it, and how to prepare yourself for these upcoming changes, among others.

Who Is Covered and What Are the Criteria?

Before we dive into the policy itself, let’s understand how HMRC defines ‘Sole Trader’ and ‘Landlords’ in the context of MTD ITSA.

Sole Trader: HMRC defines a Sole Trader as a self-employed individual who owns and manages their own business and is personally accountable for its profits and debts. Anyone under employment while also running a self-employed business will fall under the purview of Making Tax Digital.

Landlord: A landlord includes anyone earning income from renting property in the UK, whether residential, commercial, holiday home, or a combination. It doesn’t matter if the rental property in question is the only source of income or an additional source.

If total property income plus any self-employment income exceeds the MTD threshold, they must maintain digital records and submit quarterly reports.

The Income thresholds for MTD:

The MTD thresholds are based on gross income, not net profit. This includes accounting firms with many clients, with high turnover and low margins.

2024–25: Those with income over £50,000 during FY 2024-2025 will be taxed under the new system. While the first mandatory digital reporting under MTD ITSA will come into effect for FY 2026-2027, the income tax under review will be for the prior year.

2025–26: For income not exceeding £30,000, tax assessment will begin from FY 2025-2026. Like the previous threshold, MTD ITSA commencement will start from 2026-2027.

2026–27: The range extends yet further to individuals with an income of over £20,000, mandate commencing 6 April 2028. The relevant period for assessing this threshold would be the 2026 to 2027 tax year.

For now, income earners below the £20,000 threshold are excluded from the mandate. However, it’s important to keep in mind that HMRC continues to lower the income threshold for MTD’s scope.

The Proposed Timeline of MTD for Landlords

How to prepare for it

Getting ready for MTD involves several practical steps to ensure an individual remains compliant and prepared for the new digital tax system.

Assessing Current Record-Keeping

The first step is to review how the business currently tracks its financial records. It might be using paper files, spreadsheets, or accounting software. It’s essential to identify what needs to change to meet MTD requirements, which means digital record-keeping that can connect with HMRC’s systems.

Choosing the Right MTD-Compatible Software

Select software approved by HMRC for MTD compliance. This could include accounting software with built-in MTD features or bridging tools that record transactions digitally for HMRC. When choosing software, considerations should include:

- Ease of use and navigation

- Cost and support options

- Compatibility with existing accounting processes

Many providers offer free trials or demos to help users find the best fit.

Digitizing Financial Records

The business should start converting paper or traditional records into digital formats. It’s important to regularly upload receipts, invoices, and other documents into the chosen software. Keeping accurate, current digital records is crucial for smooth submissions.

Establishing a Quarterly Tax Update Routine

A quarterly tax update routine is important as MTD ITSA requires quarterly updates, avoiding last-minute compliance stress.

Registering for MTD with HMRC

Before submitting digital reports, it’s a must to register for MTD on the Government Gateway online service. It’s vital to ensure that tax information is current before registering. Details needed include the business’s National Insurance number, start date, and chosen accounting method, i.e., Cash or Accrual.

Potential Challenges

Challenges for Sole Traders and Landlords

- Adapting to Digital Systems: Moving from paper or spreadsheet records to fully digital accounting can be time-consuming and require learning new software.

- Maintaining Accurate Records: Sole traders must consistently track income and expenses to meet quarterly reporting requirements. Any errors could result in penalties.

- Understanding Eligibility: As HMRC gradually lowers the income threshold, sole traders must stay informed about whether they now fall under MTD requirements.

- Tracking Multiple Properties: Landlords with several rental properties may face difficulties consolidating income and expenses into digital records.

- Complex Income Streams: Managing diverse sources of rental income, residential, commercial, and holiday lets require careful categorization for accurate reporting.

- Quarterly Updates: Many landlords are used to annual reporting; adapting to a quarterly update schedule can be challenging.

What this means for accounting firms in the UK

For accounting firms, these challenges involve efforts to support their clients through the significant shift to digital tax reporting. Here are some key areas an accounting firm should concentrate on to ensure a smooth transition for clients while adhering to MTD regulations:

- Client Education: Accountants must guide clients through the transition to digital systems and ensure they understand MTD obligations.

- Software Integration: Ensuring client records are compatible with HMRC-approved software can be complex, particularly for businesses with bespoke accounting processes.

- Managing Compliance Risk: Accountants are responsible for reviewing digital submissions to prevent errors that could trigger HMRC penalties.

Point-based system

HMRC has put in place a points-based penalty regime, and accounting practices are required to adhere to the regulations. If these requirements are not met, then penalties will be imposed.

A points-based penalty regime will be used by HMRC, where every late submission (quarterly update, end-of-period statement, or final declaration) earns a penalty point. Once the threshold is reached, a penalty is charged.

For annual submissions, accumulating two points results in a penalty. For quarterly submissions (also applicable to MTD for IT), four points lead to a penalty. For monthly submissions, accruing five points will result in a penalty. £200 would be charged as a penalty per subsequent missed submission.

Here are the criteria for implementing the penalty system that accounting firms must follow:

Submitting Incorrect or Incomplete Figures

Providing false or incomplete self-employment or property income is a penalty point offence. Should the points tally reach a certain level, HMRC issues a £200 fixed penalty for every threshold breached. Additionally, persistent issues could lead to an investigation and further fines.

Not Keeping Digital Records

HMRC can impose fines of up to £3,000 per quarter for intentional non-compliance. Firms need to keep client records completely digital to prevent these daily penalties.

Failure to meet submission deadlines

Late submissions quarterly, monthly, or annually incur penalty points. When thresholds are met, HMRC can impose a £200 fine per instance for annual, quarterly, and monthly submissions, respectively.

Benefits of Outsourcing MTD for Income Tax Work

Switching to a new digital system can feel like stepping into unfamiliar territory. So, it’s understandable to outsource accounting tasks to handle the transition. Here are some benefits of choosing Acobloom and outsourcing for MTD readiness.

1. Accounting and Bookkeeping Expertise

Outsourcing allows you to have access to accounting and bookkeeping experts who stay up to date with HMRC regulations and policies. They manage digital records, quarterly updates, and submissions for you, leading to reduced errors and the risk of penalties.

2. Time Savings

Handling digital records, updating software, and preparing quarterly submissions can be time-consuming. Outsourcing allows businesses and accountants to concentrate on core business activities while we manage the compliance tasks.

3. Streamlined Processes

Professional providers apply proven workflows, automation tools, and integrated software skills. This guarantees accurate data capture, reconciliation, and reporting in line with MTD standards.

4. Cost Efficiency

Outsourcing often costs less than hiring full-time staff or spending many hours on MTD compliance. We aim at reducing errors, avoiding penalties and enhancing workflow, that too at 60% lesser cost.

5. Peace of Mind

Outsourcing ensures quarterly submissions are timely and accurate. Clients and accountants can rely on specialists for compliance, allowing resources to be focused on growth and strategic goals.

Conclusion

With the ultimate goal to move towards a fully digital tax submissions, HMRC plans to lower the Income Threshold for Making Tax Digital thereby increasing the scope. Starting preparations early helps businesses stay compliant, minimises stress during the transition, and maximises the efficiency of digital systems.

At Acobloom, we work with accounting firms based in the UK to facilitate this transition. Using our expertise in compliance, taxation, and tailored outsourcing services, we prepare firms and their clients for MTD. We allow accountants to focus on delivering valuable advisory services, while we oversee the accuracy, security, and efficiency of backend operations.