Accounting is a subject most people, especially business owners, are familiar with. Its role in ensuring accuracy and maintaining reliable financial records is well understood. However, one area that often gets overlooked is Financial Planning & Analysis (FP&A), an equally key component of sound financial management.

Business owners know that financial operations are the backbone of any organization. Without strong financial management, even the most innovative ideas can crumble under the weight of poor forecasting, cash flow issues, or inefficient use of resources.

A good analogy is to think of financial management as a castle; while Accounting and Financial Planning & Analysis (FP&A) are the two pillars supporting it from opposite ends. For business owners, they are constantly interacting with subject matter experts in these fields; it’s essential to understand the details of these subjects, how each function contributes to the company’s overall financial health, how they differ, and how they work together to support smarter, more informed business decisions.

This blog provides a clear picture for businesses regarding the role and placement of Accounting and FP&A within the financial management pipeline, helping leaders see how both functions align to strengthen long-term performance.

What is the difference between FP&A vs Accounting

Accounting records, classifies, and reports a company’s financial transactions, ensuring accuracy and compliance. It provides a clear view of financial position through reports like the balance sheet, income statement, and cash flow statement. Essentially, accounting narrates the business’s financial story and supports decision-making.

Financial Planning & Analysis (FP&A) uses accounting data to forecast future performance. It analyzes past trends, creates budgets, forecasts, and models to guide strategy. FP&A helps leadership understand the reasons behind the numbers, identify profitability drivers, risks, opportunities, and resource allocation to optimize impact. Its goal is turning financial data into actionable plans that foster growth, enhance efficiency, and align operations with long-term goals.

| Aspect | Accounting | Financial Planning & Analysis (FP&A) |

|---|---|---|

| Primary Focus | Recording, classifying, and reporting past financial transactions | Forecasting, budgeting, and analyzing future financial performance |

| Time Orientation | Historical – looks at what has already happened | Forward-looking – focuses on what is likely to happen |

| Key Responsibilities | Bookkeeping, financial statements, compliance, audit preparation, tax management | Budgeting, forecasting, variance analysis, and strategic financial modeling |

| Goal | Ensure accuracy, transparency, and compliance with financial reporting standards | Drive business strategy and performance through insights and decision support |

| Tools & Systems | ERP systems (e.g., SAP, Oracle, QuickBooks) | BI tools, financial modeling software (e.g., Adaptive Insights, Anaplan, Excel) |

| Stakeholders | External: auditors, tax authorities, investors | Internal: executives, department heads, strategic planners |

| Output | Balance Sheet, Income Statement, Cash Flow Statement | Budgets, Forecasts, Management Reports, Scenario Analyses |

| Decision Type | Compliance and operational decisions | Strategic and tactical business decisions |

How they work together to drive better business decisions

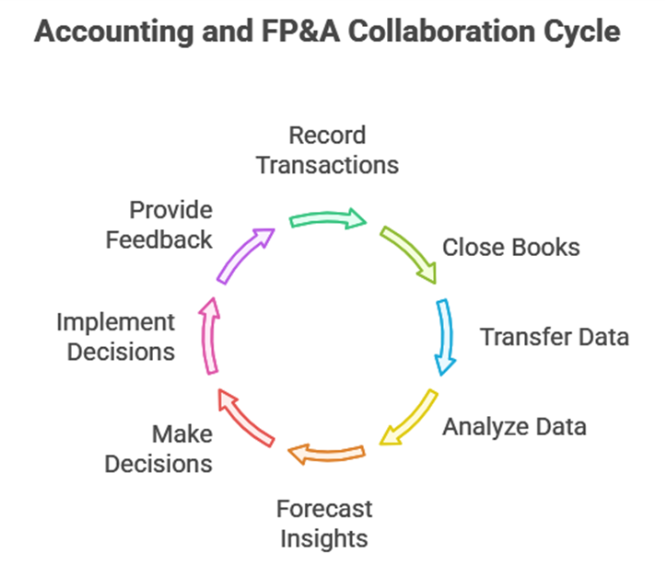

Collaboration between Accounting and Financial Planning & Analysis (FP&A) is an ongoing process, not just a one-time data exchange, forming the core of the organization’s financial management pipeline. Each function plays a vital role in giving business leaders a comprehensive view of the company’s current status and future direction. This partnership links transactional precision with strategic insight, enabling better, quicker, and more confident decision-making.

The process starts with accounting, where every financial transaction is recorded, validated, and categorized. This step ensures that revenues, expenses, assets, and liabilities are accurately captured and adhere to accounting standards. Since Accounting’s main goal is to close the books each period, it produces verified financial statements such as the balance sheet, income statement, and cash flow report. These outputs serve as the foundation for the entire financial process and are the raw data that FP&A relies on for analysis and forecasting.

Once the books are closed, the verified data moves to FP&A. This marks the point where historical data becomes the basis for strategic analysis. FP&A consolidates figures from accounting systems and incorporates them into planning tools or financial models. This data transfer must be seamless and timely, as delays or inaccuracies can skew forecasts and weaken the link between operational results and financial outcomes. Integrated systems and clear communication ensure both teams work from a single, reliable source.

With accurate data, FP&A begins analyzing. This involves comparing actual results to budgets and forecasts, identifying variances, and exploring their causes. For example, if revenue misses expectations, FP&A investigates whether the issue stems from sales volume, pricing, or costs. During this stage, FP&A often collaborates with Accounting to trace anomalies or refine data classification, creating a feedback loop that continually improves data quality and reporting.

Next, FP&A converts past performance into future insights via forecasting and scenario planning. Using accounting’s historical data as a baseline, FP&A models potential future outcomes considering trends, market conditions, and strategic initiatives. These forecasts help management anticipate challenges, allocate resources wisely, and adjust plans proactively. During this phase, accounting’s accuracy provides FP&A with the confidence needed to make realistic and strategic projections.

When decisions need to be made, Accounting and FP&A work together to provide leadership with a unified financial view. Accounting ensures that all figures are accurate, compliant, and aligned with policies. FP&A interprets these figures, highlighting risks, opportunities, and the likely impact of strategic options. Whether assessing new investments, managing cash flow, or evaluating profitability, this partnership guarantees decisions are based on factual precision and analytical clarity.

The cycle completes with ongoing feedback and improvements. After implementing strategic decisions, their results are re-recorded by accounting. These updated results feed back into FP&A’s models for future forecasting and analysis. Over time, this cycle enhances forecast accuracy, operational efficiency, and strengthens the business’s financial foundation.

Conclusion

For businesses, a perfect financial management system means mastery of both Accounting and Financial Planning & Analysis (FP&A). Accounting delivers the precision and control needed to understand where the company stands today, while FP&A provides the strategic foresight to plan for where it should go next. When both functions are well developed and aligned, they create a powerful financial engine, one that turns data into insight and insight into action.

Strong Accounting ensures integrity and compliance, building trust in the numbers. Strong FP&A turns those numbers into a roadmap for growth, efficiency, and profitability. Together, they enable leaders to make confident, data-driven decisions that balance stability with opportunity.