Behind the screen of an accountancy practice is an accountant who sits and matches spreadsheets of records against bank statements, invoices, receipts, and entries in the general ledger. While this might be a common scene for accounting practices, data sources tell us a different picture. That tedious task that an entry-level accountant has to perform day in and day out can be replaced with more value-driven tasks.

Reports from 2025 show that some 45% firms outsourced their operations to an accounting firm. So, what’s leading to this trend of accounting practices moving their operations to a partner firm?

This blog post will answer all these questions for any accounting practice seeking an all-around understanding of outsource bookkeeping for accountants services.

Things to Consider Before Outsourcing Bookkeeping Services

Provider and service evaluation

The services to be provided must therefore be specified with clarity to ensure complete comprehension of the activities to be contracted out. Activities can range from simple data entry to sophisticated payroll processing, cash flow management, financial reporting, and strategic planning. Clearly spelling out this responsibility will clarify expectations, avoid misunderstandings, and, if necessary, help you choose the right outsourcing partner to fulfil your organisation’s needs.

Provider reputation and qualifications

Thorough research into the service providers is paramount. It will always make much more sense to peruse online reviews and testimonials from independent sources to get an idea about their reputation. Besides, referrals from trusted contacts will go a long way. Confirm their qualifications and check for affiliations with professional organisations or bodies to help assure their credentials and expertise in the field of performance.

Expertise and industry experience

The service provider must have experience working with businesses similar to yours in your industry. In this manner, the provider would understand the challenges and requirements specific to your sector and address your needs accordingly. Not only would the collaboration be smoother, but the chances of successful outcomes in your situation within your business environment would increase as well.

Scalability

You want a company that will scale its services up or down as your business grows and your needs change, offering flexibility at every step of development. In such a case, the company you are partnering with must be able to scale up or down as demand grows or declines, thereby helping optimise resources and efficiency. Finding an agile provider like this will prove instrumental in achieving sustainable growth and long-term success.

How to outsource bookkeeping for accountants the right way

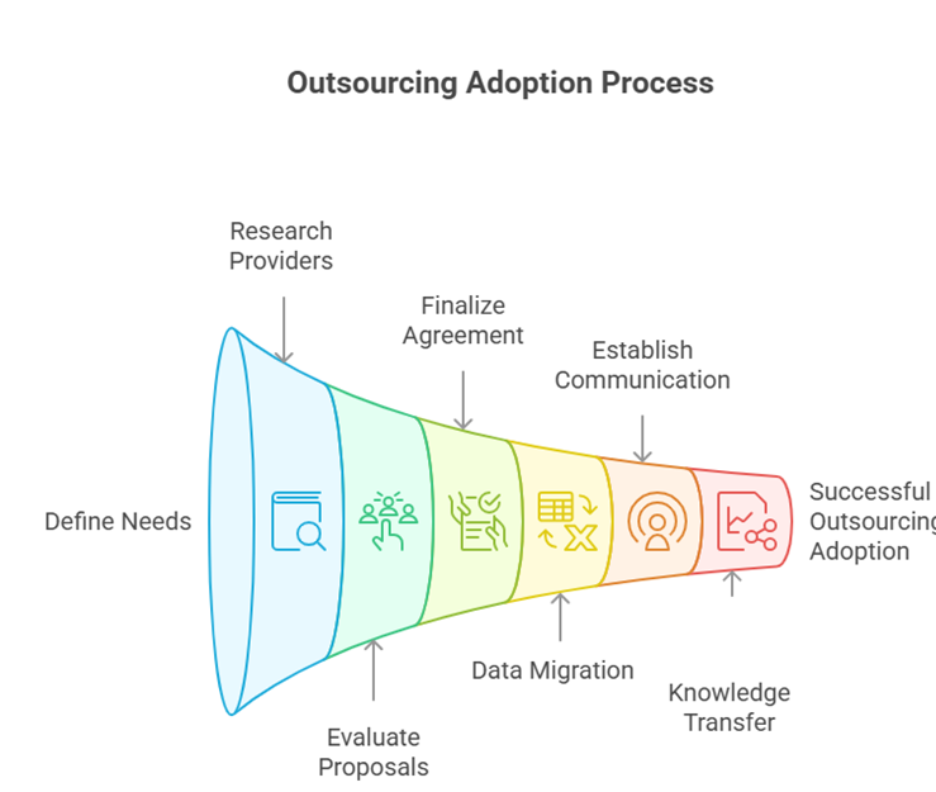

Let’s start with a two-phased process: first, preparation; second, full implementation of the process of outsource bookkeeping for accountants.

Pre-Outsourcing

Define needs by fully documenting current bookkeeping processes, identifying pain points, and specifying desired outcomes. Examples may include cost savings, increased accuracy, or access to specialised skills. Also, outline the specific requirements that will be necessary, such as compatibility with the software presently used and the frequency of reporting required, so that it aligns with your business operations.

Research providers based on finding reputable bookkeeping services or firms that specialise in your industry. Prefer those with established security protocols, broad communication channels, and qualified personnel, such as CPAs or certified bookkeepers. Shortlist firms after carefully reviewing them.

Once you have a shortlist, request detailed proposals from these service providers. Study each proposal in detail and schedule interviews to understand their approach to your specific business needs. Check references and ask for case studies or examples that demonstrate their capabilities and success stories, ensuring they can deliver the required services.

Once you have selected a suitable provider, finalise the agreement. Create a clear contract that outlines the scope of work, fee structure, confidentiality clauses, and other relevant legal considerations. Develop a comprehensive onboarding plan to support a smooth transition through training, data migration, and the establishment of a communications protocol.

Adoption of Outsourcing

Data migration and system integration are crucial to working with an external financial service provider. This process guarantees the secure transfer of valuable financial data, such as transactions, account balances, and historical information, so everything is correctly set up. In most cases, you will need to integrate your accounting software with the provider’s systems; this may involve custom configuration, testing, and compatibility checks to prevent data loss or other errors.

One of the cornerstones of any partnership is a clear communication system. Defining the rules of interaction involves specifying the periodicity of meetings or updates and the channels through which they will be communicated. It identifies preferred modes of communication, including weekly conference calls, shared online documents, or dedicated email addresses, and outlines the means for smooth interaction to avoid misunderstandings.

Effective knowledge transfer is also necessary to preserve continuity and operational integrity. Through close collaboration with the provider in sharing extensive information about your business, including accounting policies, chart of accounts, and operational procedures, the provider will be thoroughly informed about your environment. Only through such comprehensive institutional knowledge transfer does a provider have an opportunity to perform their duties correctly and align their work to accommodate your particular needs adequately.

One generally accepted method to further minimise risks when transitioning is to run the systems in parallel. This means you can run your internal and outsourced systems side by side for a defined period to match outputs, check data for accuracy, and address any discrepancies that arise. This helps build confidence in the new system and minimises the chances of costly errors.

Finally, early review and feedback are very important in an outsourcing process. It is necessary to evaluate the deliverables of the first few cycles, such as reconciliations and financial reports, by checking their accuracy and reviewing their performance. Giving timely, constructive feedback enables the correction of mistakes, the refinement of procedures, and the adjustment of expectations, thereby fostering a smooth, effective relationship with your provider.

Conclusion

Outsourcing bookkeeping done right creates a competitive advantage for accounting firms by unburdening their workloads and enhancing their overall efficiency. Besides taking routine tasks off accountants’ shoulders, this provides access to specialised expertise, enhances accuracy, and offers a range of additional services and professional insights from skilled outsourcing providers. Embracing outsourcing as a core component of operational strategy often improves service quality, saves money, and makes available resources that would be better used on high-value-added pursuits.

The best way to outsource bookkeeping for accountants is to adopt a holistic approach and select a service provider that not only assists with the bookkeeping process but also simplifies the overall outsourcing experience, rather than one that makes it more of a hassle.