Form 1040, the Individual Income Tax Return, is just two pages long but is likely one of the most important forms CPAs prepare every tax season. It is required to be filed annually by most individual taxpayers, wage earners, investors, and self-employed individuals to report income, deduct, and calculate their federal tax liability.

For CPA firms, the Form 1040 tax return is not only a mandatory compliance but also a higher-value advisory services opportunity. For that reason, proper preparation is needed to deal with IRS compliance, gain the confidence of clients, establish advisory relationships, and create tax planning engagement opportunities.

Because it’s so important, one of the aspects of it that needs expertise is Schedule A, which requires strategic judgment. For the reason that what is actually known about Schedule A’s nuances, such as what does or does not qualify, when to itemize, and how to report deductions, can in fact lead to direct effects on compliance accuracy and client satisfaction.

This is a step-by-step guide on how to fill out Form with special focus on Schedule A, which is one of the most vital sectors where professional guidance can produce a substantial impact in their clients’ cases.

How to fill out Form 1040

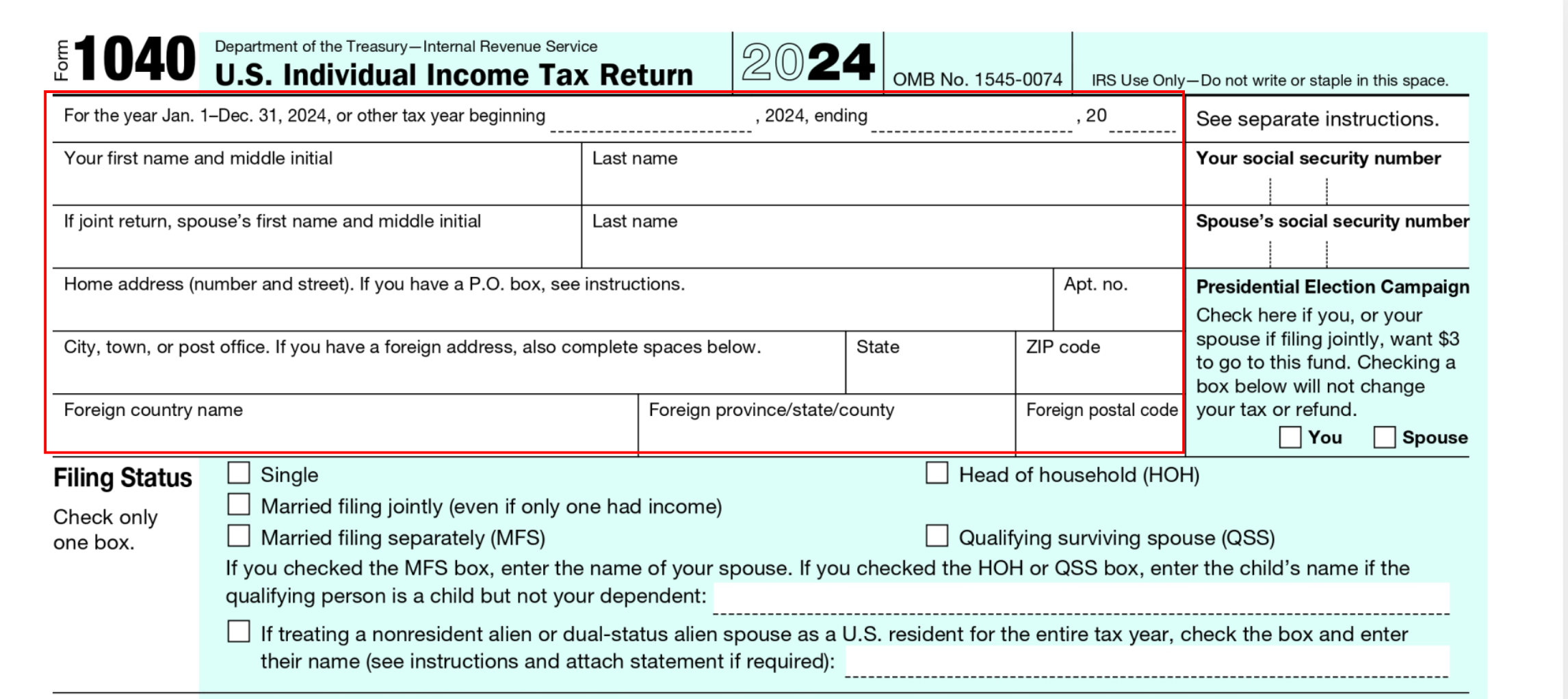

1. Entering Personal Information

Begin by entering your name, Social Security Number, and home address exactly it appears on your Social Security card and official mail. If you are filing jointly, also enter your spouse’s information. Be sure to check the correct filing status box: single, married filing jointly, married filing separately, head of household, or qualifying surviving spouse based on your household and dependent situation. If someone else can claim you as a dependent, indicate that here.

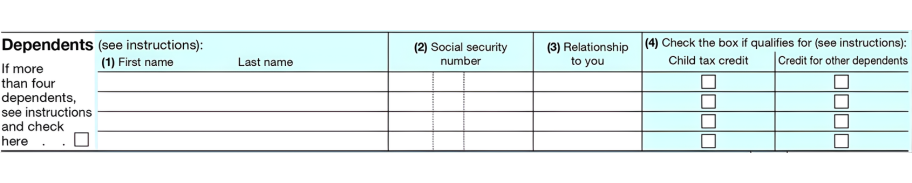

2. Enter Dependants Information

In the dependents section, list the names, Social Security Numbers, relationships, and child tax credit eligibility for each dependent you are claiming. Dependents typically include children under 17 or other qualifying relatives you financially support. Make sure every dependent’s Social Security Number is correct; incorrect entries can delay processing or cause rejection of your credit claims.

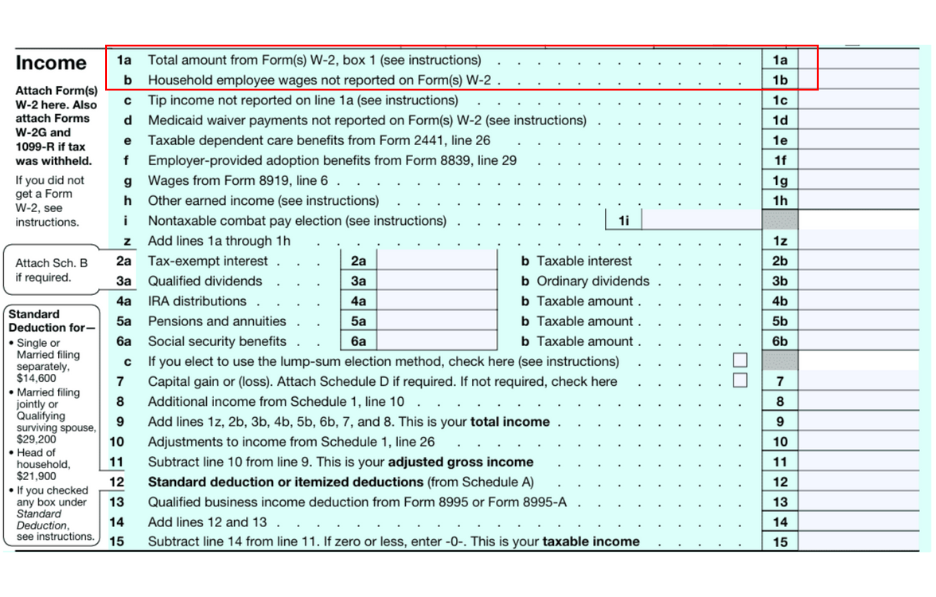

3. Enter Income Included in W-2 Form

Next, report your total income. Start with wages, salaries, and tips as shown on your W-2 forms. Then include interest, dividends, IRA or pension distributions, unemployment compensation, Social Security benefits, and other income such as gig-work or self-employment earnings. You will total all these on the appropriate lines.

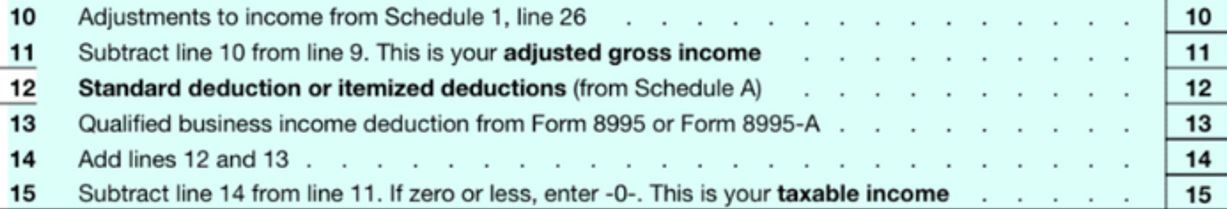

4. Add Adjustments To Reduce Taxable Income

After calculating your income, you can make certain adjustments that reduce your taxable income even before applying deductions. These are known as “above-the-line deductions” and are recorded on Schedule 1, Part II. Examples include educator expenses, IRA contributions, student loan interest, self-employment tax deductions, and health savings account (HSA) contributions. Subtracting these adjustments from your total income gives you your Adjusted Gross Income (AGI), a key figure that affects your eligibility for credits and deductions throughout the form.

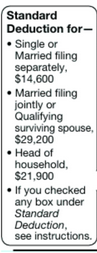

5. Select Your Standard Deduction

After determining your AGI, choose between taking the standard deduction or itemizing on Schedule A to reduce your taxable income. The standard deduction is a set amount based on your filing status and age, offering a simple option for most taxpayers. Suppose your deductible expenses, such as medical costs, state and local taxes, mortgage interest, charitable donations, or casualty losses, are higher than the standard deduction. In that case, itemizing may lower your tax bill more effectively. Enter the total from Schedule A or the standard deduction (whichever is larger) on Form 1040 to get the best tax benefit.

6. Calculate Your Taxable Income

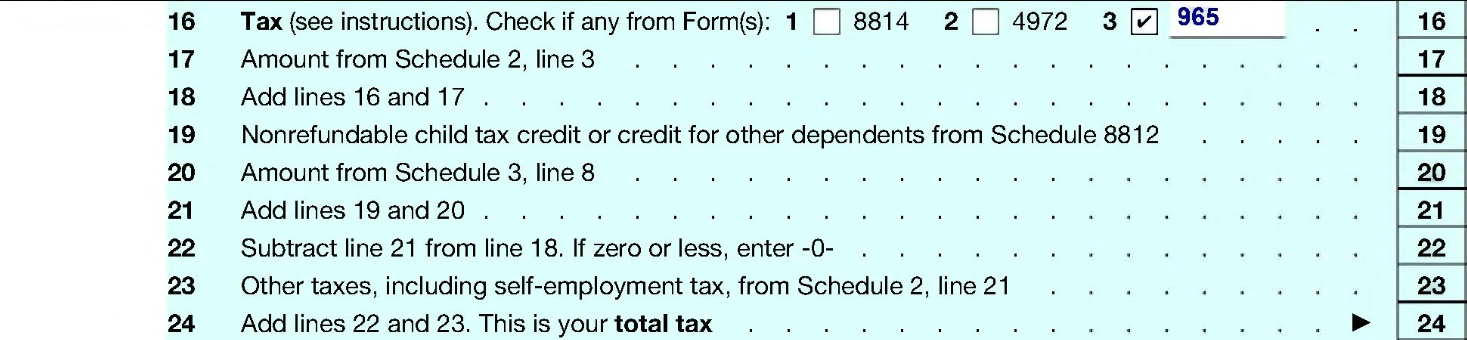

Subtract your deductions from your AGI to get your taxable income. Then, using the IRS Tax Tables, determine the amount of income tax owed based on that figure. Next, apply any nonrefundable credits such as the Child Tax Credit, Education Credits, or Foreign Tax Credit to reduce your tax liability. These credits cannot reduce your tax below zero, but they can significantly decrease the amount you owe. If you qualify for refundable credits, like the Earned Income Credit or Additional Child Tax Credit, those are entered later in the “Payments” section.

7. Add Additional Sources of Income

If you owe additional taxes beyond your basic income tax, report them here. These can include self-employment tax, household employment tax, early withdrawal penalties on savings, or the repayment of advance premium tax credits. The details for these are usually calculated on Schedule 2 and then transferred to Form 1040. This step gives you your total tax before taking into account any payments or withholding already made.

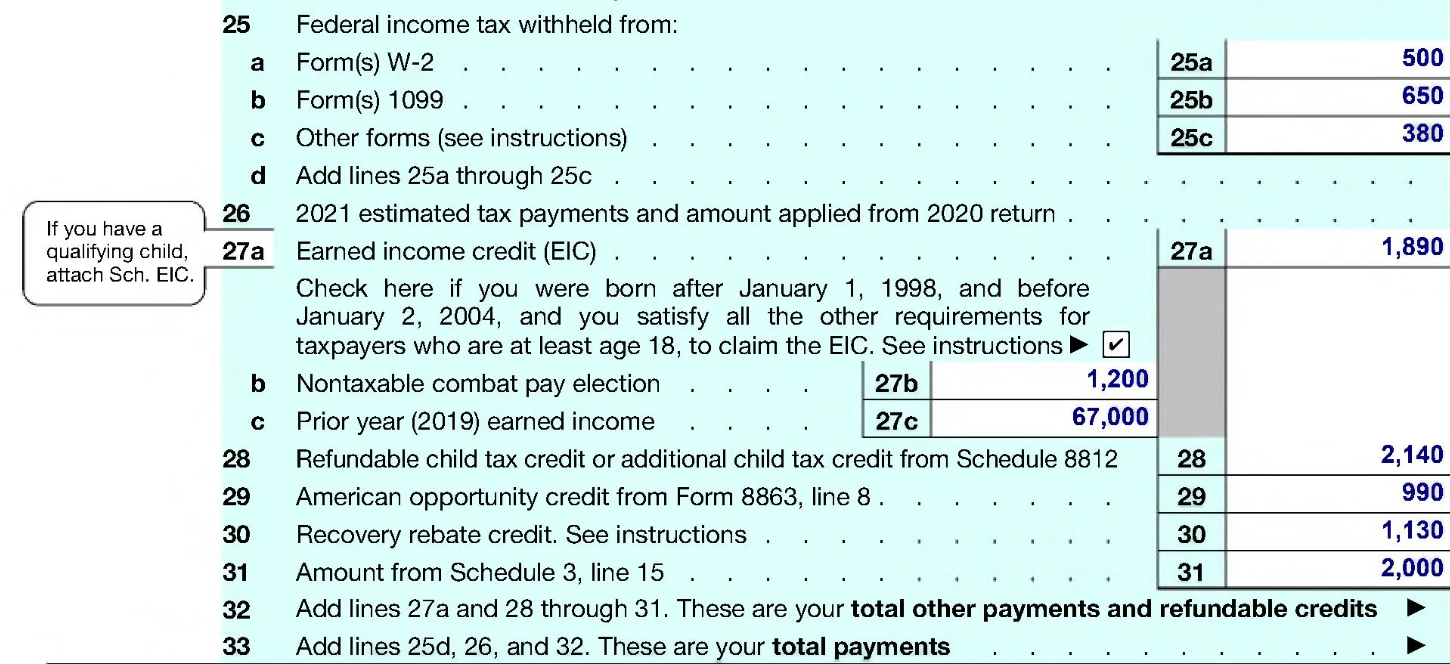

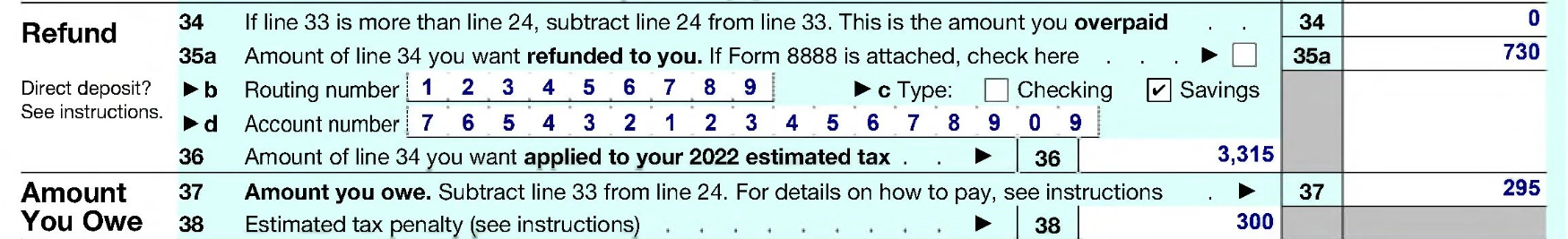

8. Tax Refunds and Payments

Compare your total payments with your total tax. If your payments exceed your tax liability, you’re entitled to a refund. Enter your bank routing and account numbers to receive your refund by direct deposit. It’s faster and more secure than a mailed check. If you owe more tax, the difference is your balance due. You can pay electronically via IRS Direct Pay, by debit or credit card, or by mailing a check with your return. If you can’t pay the full amount, you can request an installment plan through the IRS.

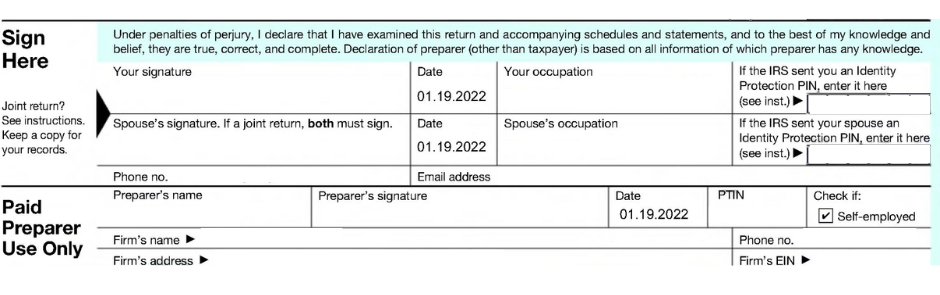

9. Complete Your Form 1040

To complete your tax return, you must sign and date Form 1040. If you are filing jointly, both you and your spouse must sign. Include your occupation and the date of signature. If you used a paid preparer, they must sign the return as well and include their Preparer Tax Identification Number (PTIN) and firm information. Unsigned returns are considered invalid and will not be processed, potentially delaying any refund.

What is Schedule A?

Schedule A is a supplementary form along with Form 1040, where specific itemized tax deductions are listed and claimed instead of taking the standard deduction. For instance, for 2025, the unmarried and separate filers’ standard deduction is $15,750. For married joint filers/Qualified Widowers, it is $31,500, and for heads of household, it is $23,625. It allows all U.S. taxpayers to take qualified deductions such as home mortgage interest, state and local taxes, charitable contributions, and medical and dental expenses.

Get Ready for the Upcoming Tax Season Today!

Don’t wait for deadlines

Start early with a free tax prep trial ↗Advantages of Schedule A itemization

Medical and Dental Expenses:

Taxpayers can deduct qualified, unreimbursed expenditures of themselves, their wives/husbands, and dependents above 7.5% of their Adjusted Gross Income (AGI). Dental charges, eye tests, and other medical treatments not reimbursed through insurance or otherwise qualify.

Qualifying expenses can be medical visits, prescription medication, hospitalization, mental health care, dental work, eye examinations, eyeglasses, contact lenses, and preventive services. Be sure to have good receipts and records, so that only those expenses that are over 7.5% of Adjusted Gross Income (AGI) are tax-deductible.

Mortgage Interest:

Interest on a home mortgage to purchase a principal residence or a residence other than a principal residence can be deducted. Limits apply to the deductibility of how much of the mortgage is deductible, depending on when the mortgage is purchased and other factors.

Interest on a mortgage is usually tax-deductible for mortgages of modest size. The tax deduction will cut taxable income substantially for most homeowners who have paid large amounts of interest in the year. Retain copies of Form 1098 from the lender, which will state the interest paid.

State and Local Taxes (SALT):

A taxpayer can deduct up to $10,000 of state and local income taxes or sales taxes. They can also subtract real property taxes and personal property taxes, but the aggregate amount of these taxes cannot be greater than $10,000. If they prefer to subtract sales taxes rather than income taxes (If living in a Tax-exempt state), they can save bills or receipts for expensive purchases that will support the deduction. This limit applies especially to those who reside in states with high taxes since it sets a cap on the number of SALT taxes that can be deductible in a given year.

Charitable Donations:

Contributions to eligible charitable organizations are deductible. They can be cash, goods, or property. To qualify, the organization needs to be certified by the IRS as a charity, e.g., nonprofits, schools, churches, and some community groups.

When donating other valuable possessions or property, donors may be required to identify the fair market value and maintain proper records. The donation of the appreciated assets generates further savings in taxes through exemption from capital gain taxes.

How to File Schedule A

To complete Form 1040, it is advisable to have all the statements, receipts, and evidence of expenses one desires to claim as deductions, such as medical expenses, statements of property taxes paid, statements of mortgage interest, charitable donation receipts, and statements of state or local taxes paid. This way, things remain accurate, and one can support deductions in case of an IRS audit. It is a good idea to keep all the records in electronic versions for personal purposes.

After receiving all these supporting documents, they can go ahead and complete Schedule A. They need to start with medical and dental expenses; they can only claim the amount over 7.5% of their Adjusted Gross Income (AGI). They can then report taxes paid, including state and local income taxes, real estate taxes, and personal property taxes, up to a maximum of $10,000 SALT ($5,000 if married filing separately).

They may then add mortgage interest and any points paid on a home mortgage with information from Form 1098. Contributions to qualified organizations must also be added; cash contributions must be substantiated on bank statements or receipts. Other deductible items, like casualty and theft loss (in federally declared disasters) or other miscellaneous deductions, may also be added. Lastly, they have to carry forward all the itemized deductions, and the sum will be carried over to Form 1040.

After filling out Schedule A, it is to be attached to Form 1040 when filed. This way, the itemized deductions are presented in a clear form on the main return. Ensure that the sum of Schedule A is correctly reported in the “Itemized Deductions” space on Form 1040. Incomplete attachments or inaccurate matches can slow down IRS processing or result in follow-up letters.

After they fill out the forms, they either e-file or send by mail the return. The e-filing process typically is quicker, more secure, and less prone to errors as tax software automatically screens for errors. E-filing also guarantees quicker confirmation from the IRS and quicker refund processing. In the event of mailing the return, it must be mailed to the appropriate IRS address of the respective state, as indicated on the official website of the IRS. It is a good practice to keep a copy of the entire return and proof of filing on hand.

How filling out the Form 1040 can differ based on your tax situation

While every taxpayer submits the same Form 1040, the way you fill out Form 1040 can vary significantly depending on your income sources, filing status, and deductions. Each situation carries unique requirements, additional schedules, and potential tax advantages.

Here’s how Form 1040 differs across common scenarios:

| Scenario | What to Do | Forms/Schedules | Difference |

|---|---|---|---|

| Single Income | Report W-2, take standard deduction | None | Simple and quick |

| Self-Employed | Report income & expenses | Schedule C, SE | Pay income + self-employment tax |

| Married Jointly | Combine spouses’ income & deductions | Maybe Schedule A | Can lower taxes; both must sign |

| Itemizing Deductions | List mortgage, medical, and charitable | Schedule A | May reduce taxable income more |

| Dependents / Credits | Report dependents, claim credits | Schedule 8812 | Credits reduce tax owed directly |

Common Mistakes to Avoid While Filling Out Form 1040

Failure to Sign the Form

While filing your tax return, note that the IRS will not accept an unsigned return. To ensure that your filing is done without complications, always sign the tax return services if you’re filing jointly with your husband or wife.

Entering Incorrect Personal Information

Small mistakes like misspelled names, incorrect Social Security numbers, or outdated addresses can trigger serious processing delays in your Form 1040 tax return processing. All mistakes include additional verification and repair processes that slow down the whole process.

Besides, giving false or misleading information, whether intentionally or unintentionally, can lead to severe sanctions, such as fines, prosecution, or even criminal action in certain situations. It is thus imperative to recheck all individual information prior to submitting it in order to avert sanctions.

Misreporting Income

The failure to report all of the W-2s, 1099s, or any other income source when reporting income taxes will result in underreporting of income. It is one of the most frequent causes that result in an IRS audit. Underreporting of income, even unintentionally and even intentionally, can also attract penalties, charges of interest, and extra fines.

The IRS may impose a penalty of 20% of the underpaid amount due to negligence or disregard of the rules. The penalty can be up to 75% of the unpaid tax in the case of fraud. It is necessary to report all income correctly in order to escape such penalties and also follow tax norms.

Selecting the Incorrect Filing Status

Selecting the wrong filing status on your tax return that isn’t accurate to your own status can carry substantial penalties. Not only can it impact your overall tax rate, possibly causing you to pay more than you need to, but it can also take away from you the advantage of some deductions and credits that are only available to specific filing statuses.

Entering the wrong status could have the IRS ask you to file an amended return, and this is time-consuming and could also incur additional fees. Additionally, if the IRS finds that you have done this by mistake so that you would be unable to pay taxes, you could be penalized.

The penalty for an incorrect tax return, such as a wrong filing status, includes the underpayment caused by the mistake plus any interest charges that may apply. Willful or fraudulent mistakes may lead to harsh penalties for auditors.

Mathematical or Typographical Errors

Hand computations are subject to mistakes, including transposed numbers or calculation mistakes, which will result in simple errors in your tax refund or the amount you owe. Such mistakes will slow down processing your return and can even attract penalties and audits. To prevent such issues, meticulously double-check all numbers or use error-free tax software that automatically verifies for errors.

Mistyping your direct deposit routing or account numbers will delay or misdirect your refund. It is not only a nuisance, but it can also impact your budgeting. Double-check your banking information when you prepare your return and call your bank if you are uncertain what it is.

Failure to Attach Required Schedules or Forms

If your tax situation involves itemized deductions or reporting specific sources of income, failing to file necessary schedules or forms can result in the rejection or delay of your tax return. For example, common mandatory schedules are Schedule A for itemized deductions, which is crucial to ensure that all relevant forms are attached, filled out properly, and accurately detail your financial standing prior to the filing of your return.

Omitting required schedules or giving inaccurate data may trigger a penalty in the form of a fine, interest on unpaid tax, and possible audits. The IRS would impose a penalty for failing to pay or file tax payments on time, which would increase over time unless rectified at once. To prevent these, double-check every one of your documents and speak with a tax professional if you are not sure about your forms or the schedules that you require.

Conclusion

Properly filling out Form 1040 and submitting it is essential to tax compliance and financial disclosure efficiency. For CPA firms, facilitating clients in the submission and preparation of their form appropriately is an essential function in consultancy. They may guide clients regarding credits, deductions, and record-keeping obligations so they can get the most out of their returns and prevent auditors.

AcoBloom tax professionals guarantee excellent guidance throughout filing, error-free submissions, and elimination of expensive missteps, particularly valuable as the time for taxes approaches. Expert assistance removes anxiety and enables you to focus on what is most important, while ensuring full compliance with IRS guidelines.

It’s also important to retain a copy of your Form 1040 tax return, both in electronic and physical form, for yourself. This record can prove useful in the event of an audit, corrections, or future reference. Not retaining copies may impede your ability to confirm previous filings or answer inquiries from the IRS.

Moreover, the IRS advises keeping these records for a minimum of three years, but in certain cases, for instance, if you reported a loss on worthless securities, you may be required to maintain records for seven years.