Tax processing has come a long way, moving from manual number crunching to digital filing for smoother operations. Now, AI is making its mark in taxation, bringing in smart tech to analyze heaps of financial data, simplify compliance, and maximize deductions. So, businesses and individuals can now handle taxes more efficiently, thanks to this tech upgrade.

What is Tax Automation?

Tax automation refers to the use of technology, particularly software and artificial intelligence, to streamline and simplify various aspects of the tax process. It involves automating tasks such as data collection, calculation, filing, and compliance to improve efficiency, accuracy, and reduce manual efforts in managing tax-related activities.

The Rise and Importance of Automating Tax Processes

In the modern era, the complexity of tax regulations, frequent updates, and the volume of financial data have made manual tax processes time-consuming and error prone. Tax automation has emerged as a solution to these challenges.

By leveraging advanced software and AI algorithms, businesses can automate tasks like data entry, classification, and calculations, reducing the risk of human errors and ensuring compliance with ever-changing tax laws.

The Power of Artificial Intelligence in Tax Automation

Artificial Intelligence mimics human intelligence in machines, allowing them to perform tasks like problem-solving, learning, and decision-making. It transforms industries like finance, healthcare, and manufacturing, processing data rapidly, recognizing patterns, making predictions, and improving through machine learning.

Artificial Intelligence (AI) plays a pivotal role in tax automation. AI algorithms can rapidly analyze large datasets, identify patterns, and predict outcomes, making it possible to optimize deductions, recognize potential audit triggers, and ensure accurate tax filings. Machine learning algorithms can adapt and improve over time, becoming better at identifying tax-saving opportunities and minimizing risks.

Overall, the integration of tax automation, powered by AI, empowers businesses to efficiently manage their tax obligations, minimize errors, and allocate resources more strategically, ultimately leading to better financial outcomes and compliance in the dynamic landscape of modern taxation.

AI vs. Traditional Computational Methods

AI differs from traditional computational methods in that it’s not solely reliant on explicit programming. Traditional methods involve writing specific instructions for computers to follow, while AI learns from data to improve its performance over time. AI can handle ambiguity, adapt to changing circumstances, and make decisions based on patterns that might not be explicitly programmed. This flexibility and adaptability give AI an edge in handling complex tasks where rule-based programming falls short.

AI-driven Tax Automation Software

AI-driven tax automation software leverages the capabilities of artificial intelligence to streamline and enhance various tax-related processes. These software solutions use AI algorithms to process financial data, classify transactions, identify tax-saving opportunities, predict audit risks, and automate the preparation and filing of tax returns.

By learning from historical data and staying updated with changing regulations, AI-driven tax automation software reduces human errors, improves accuracy, and saves time for individuals and businesses. It transforms the tax process from a manual and error-prone task to an efficient, data-driven, and compliance-focused operation.

Automated Tax Reporting

Automated tax reporting is a cornerstone of modern tax automation software. With the power of AI, these systems generate accurate and comprehensive tax reports effortlessly. They gather relevant data from different sources, perform necessary calculations, and compile the information into formatted reports that can be easily submitted to tax authorities.

This not only saves time but also minimizes the chances of mistakes often associated with manual reporting. Businesses can thus fulfill their tax reporting obligations efficiently, while focusing on core operations and growth strategies.

How AI Simplifies Tax Reporting

AI simplifies tax reporting through its ability to process and analyze vast amounts of data quickly and accurately. It automates data collection from various sources, categorizes transactions, and applies relevant tax rules based on jurisdictional requirements. AI-driven algorithms perform complex calculations, ensuring accurate tax liabilities and deductions.

Additionally, AI software can stay updated with changing tax regulations, adapting to new rules seamlessly. It also identifies potential errors and inconsistencies, providing real-time alerts for correction. By learning from historical data, AI improves its accuracy over time, reducing the manual effort needed for reconciliations and audits.

Advantages of Automating Tax Reporting Processes

Automating tax reporting processes provides numerous benefits.

- Accuracy is improved by reducing human errors from manual data entry and calculations.

- Time and resources are saved by eliminating repetitive tasks, enabling focus on strategic activities.

- Automated systems ensure timely compliance, minimizing penalty risks.

- AI-powered software offers detailed tax insights for better decision-making and planning.

- Automation enhances efficiency, reduces operational costs, and boosts overall financial accuracy.

The Ease of Automating Sales Tax

Automating sales tax is particularly simplified with AI technology. AI-driven software can effortlessly track sales transactions across various locations, accurately calculate the applicable sales tax rates based on regional laws and generate detailed reports for tax authorities. This eliminates the need for manual research, data entry, and complex calculations.

Additionally, the software can adjust to changes in tax rates or rules in real-time, ensuring ongoing compliance. The ease of automating sales tax with AI streamlines processes, reduces errors, and enables businesses to meet their tax obligations efficiently.

Understanding Sales Tax Complexities

Sales tax is a complex area of taxation, involving varying rates, rules, and regulations across different jurisdictions. Businesses need to consider factors like location-based tax rates, exemptions, thresholds, and special tax categories. These complexities increase the risk of errors in calculations and reporting, leading to compliance issues and potential penalties. Navigating these intricacies manually can be time-consuming and challenging, especially for companies with a broad customer base.

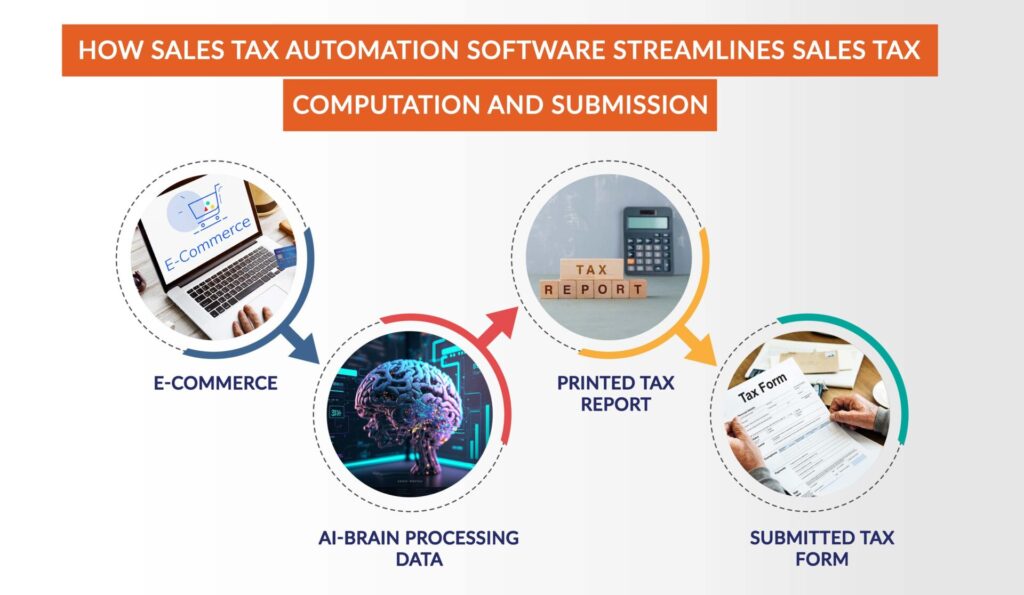

How Sales Tax Automation Software Streamlines Sales Tax Computation and Submission

AI-driven sales tax automation software simplifies the complexities of sales tax by automating various tasks. The software uses AI algorithms to accurately determine the applicable tax rates based on customer location, product type, and jurisdictional rules.

It integrates with e-commerce platforms and financial systems to automatically capture sales data. The software then computes the tax owed for each transaction, taking into account exemptions and thresholds. It generates detailed reports for accurate tax filing and can even submit taxes directly to tax authorities where allowed.

By staying updated with changing tax laws, the software ensures ongoing compliance, minimizes errors, and frees up valuable time for businesses.

Benefits of Using AI-Powered Sales Tax Automation Software

AI-powered sales tax automation software offers businesses multiple advantages.

- Manual effort in sales tax calculation and tracking across jurisdictions is eliminated.

- Automation guarantees precise tax calculations and minimizes error-related penalties.

- The software remains updated with dynamic tax laws, ensuring ongoing compliance.

- Optimization of tax deductions and exemptions is facilitated, leading to cost savings.

- Operational efficiency is enhanced, compliance risks are reduced, and resources are freed up.

- Businesses can focus on strategic initiatives due to streamlined processes.

Automated Tax: Beyond Just Reporting

Automated tax processes extend beyond reporting alone. While accurate reporting is crucial for compliance, automation also optimizes various tax-related activities. AI-powered software can identify potential tax-saving opportunities by analyzing transaction data and identifying eligible deductions. It can predict audit triggers and minimize risks by flagging transactions that might raise concerns.

Additionally, automated systems provide a centralized platform for managing tax data, facilitating efficient audits, and reducing the stress of recordkeeping. By taking care of tax-related complexities comprehensively, automated tax solutions contribute to better financial management and strategic decision-making for businesses.

Overview of Other Tax Processes That Can Be Automated

Beyond sales tax, various other tax processes can be automated to enhance efficiency and accuracy. These include:

- Tax Deductions and Credits: AI can analyze financial data to identify eligible tax deductions and credits, ensuring businesses and individuals maximize their tax benefits while staying compliant.

- Expense Categorization: AI can automatically categorize expenses based on tax rules, simplifying the process of separating deductible and non-deductible expenses.

- Income Reporting: Automated systems can aggregate income data from different sources, such as employment, investments, and self-employment, to ensure accurate income reporting.

- Tax Form Preparation: AI-driven software can generate and populate tax forms based on collected data, reducing the manual effort required for form completion.

- Document Management: Automation tools can organize and store tax-related documents digitally, making it easier to retrieve information during audits or tax inquiries.

The Role of AI in Refining and Optimizing These Processes

Benefits of AI in Tax Automation

AI-enhanced tax systems constantly refine their accuracy by processing increasing amounts of data, promptly identifying and alerting users to data inconsistencies. This automation ensures greater precision, compliance, and informed decision-making. Key advantages include:

- Enhanced Accuracy: AI minimizes human errors, ensuring correct tax calculations and reducing compliance issues.

- Efficiency: AI streamlines tax processes, resulting in time and cost savings, enabling focus on high-value activities.

- Scalability: AI-driven tax solutions cater to businesses of all sizes, adapting as they grow.

As tax technology advances, we’ll witness increased AI sophistication, real-time adaptation to changing regulations, and integration with innovations like blockchain, enhancing financial management and compliance.

Predictions on Further Integration of AI in Tax Processes:

The integration of AI in tax processes is poised to advance even further. Predictions include:

- Advanced Predictive Analysis: AI will analyze historical data to predict future tax trends, helping businesses proactively plan for tax obligations and potential savings.

- Real-time Compliance: AI will continuously monitor changes in tax regulations and update systems in real-time, ensuring immediate compliance adjustments.

- Natural Language Processing: AI-driven systems will interpret and process tax-related documents, simplifying communication between taxpayers and authorities.

- Personalized Tax Advice: AI algorithms will offer tailored tax advice to individuals and businesses based on their financial situations, optimizing tax strategies.

- Enhanced Auditing: AI will streamline auditing processes by quickly analyzing vast amounts of data, making audits more efficient and less intrusive.

Potential Impact on Tax Professionals and Consultants:

The integration of AI in tax processes will reshape the roles of tax professionals and consultants:

- Shift in Focus: Tax professionals will shift from routine data entry and calculations to more strategic tasks, such as interpreting AI-generated insights and advising on complex tax matters.

- Consulting Enhancement: Consultants can use AI-powered analytics to offer clients data-driven insights for better financial decision-making and tax planning.

- Collaboration with AI: Tax professionals will collaborate with AI systems, leveraging their capabilities to enhance accuracy and efficiency.

- Continuous Learning: Professionals will need to stay updated with AI advancements and refine their skills to effectively leverage AI in tax processes.

Example of AI in Tax Industry:

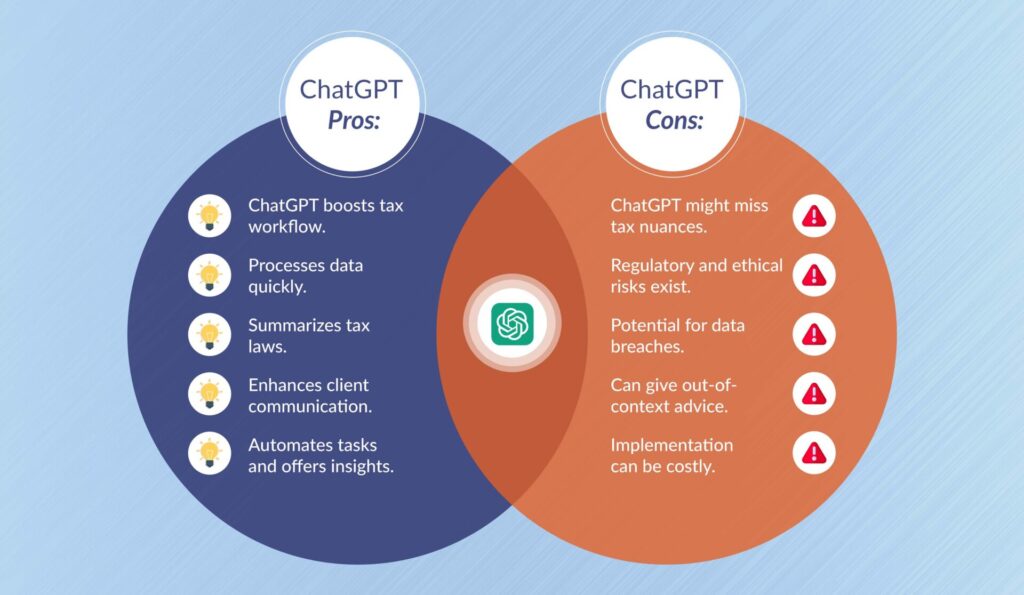

A great example of AI affecting the tax industry today is ChatGPT. Tax experts in accounting firms and corporate tax departments see the big possibilities that come with ChatGPT and similar AI technology. But they also understand that there are risks involved.

Pros of Using ChatGPT in the Tax Industry

Just as we’ve discussed the advantages of AI, ChatGPT optimizes tax professionals’ workflow by rapidly processing data, summarizing complex tax laws, and enhancing communication clarity for clients. Beyond automating routine tasks like data entry, it offers valuable insights for better decision-making. Its scalability ensures efficiency in handling large volumes of tasks, allowing professionals to concentrate on tasks needing human expertise.

Cons of Using ChatGPT in the Tax Industry

- Lack of Expertise: ChatGPT lacks the nuanced understanding of complex tax issues that experienced tax professionals possess, and it might miss critical details.

- Regulatory and Ethical Concerns: Depending on the jurisdiction, using ChatGPT for tax advice could raise regulatory and ethical concerns, especially if the AI makes incorrect or biased recommendations.

- Data Security and Privacy: Utilizing ChatGPT involves sharing sensitive financial information, which can pose data security and privacy risks if not managed properly.

- Dependency on Technology: Relying heavily on ChatGPT might lead to a reduced emphasis on developing traditional tax expertise, potentially impacting the industry’s human resource development.

- Limited Contextual Understanding: ChatGPT might sometimes generate responses that lack context or depth, leading to incomplete or inaccurate advice.

- Training and Customization: ChatGPT, like other AI models, requires training and customization to be accurate and relevant. Ensuring the AI understands specific tax regulations can be a resource-intensive process.

- Costs: Implementing ChatGPT solutions can involve significant upfront costs for development, integration, training, and maintenance.

In summary, AI like ChatGPT can be a powerful tool for tax professionals, enhancing efficiency and providing valuable insights. However, its limitations in understanding complex contexts and the need for ongoing monitoring and customization should be carefully considered. A balanced approach that combines AI’s capabilities with human expertise is likely to yield the best results in the tax industry.

Conclusion

AI’s inclusion in tax processes revolutionizes tax management, offering enhanced accuracy, efficiency, and scalability for businesses. Beyond automating tasks, AI allows tax experts to prioritize strategic roles. As AI progresses, it promises improved compliance, strategic tax planning, and smarter financial decisions, simplifying tax complexities.

Key Takeaways on AI-Powered Tax Automation:

AI Reshaping Tax Processes through Automation:

- Ensures Accuracy: Drastically reduces errors in tax calculations and reporting.

- Adapts to Changes: Maintains real-time compliance by staying current with evolving tax laws.

- Provides Insights: Predicts trends, deductions, and potential audit triggers for informed decision-making.

- Simplifies Reporting: Organizes data for streamlined and accurate submissions.

- Embrace Tax Automation Software for Business Advantages:

Boost Competitiveness: Redirect focus from manual tax tasks to strategic growth initiatives.

- Minimize Errors: Mitigate compliance risks and penalties through reduced errors.

- Save Time and Costs: Accelerate processes and trim operational expenses.

- Scale Effortlessly: Suitable for businesses of all sizes.

- Enhance Decisions: AI insights support strategic tax planning and financial management.

If you enjoyed reading this article, be sure to explore our other blogs on Accounting, Tax, and Outsourcing!

Are you ready to streamline your operations? Benefit from time savings, reduced errors, and expert assistance with AcoBloom’s outsourcing Tax services. Elevate your business with our tailored solutions and unlock efficiency and accuracy in financial strategies. Contact us now to learn more.