In today’s rapidly changing business landscape, accounting is undergoing a significant transformation. Traditional methods of manual bookkeeping are giving way to innovative technologies like AI Bookkeeping that reshape how businesses handle financial data. One of the most potent and revolutionary technologies driving this change is Artificial Intelligence (AI).

The Evolving Landscape of Business Accounting

The evolution of business accounting has been closely tied to advancements in technology. From manual ledger entries to the adoption of computer-based accounting systems, each step has brought increased efficiency and accuracy to the field.

Now, with the integration of AI, the landscape is shifting once again. AI has the potential to revolutionize the way accounting tasks are performed, from automating routine processes to providing advanced insights that were previously impossible to achieve.

The Rise of AI in the World of Accounting and Its Transformative Power

The rise of AI in accounting is transforming the profession in various ways:

- Automation of Routine Tasks: AI-powered accounting software can automate repetitive and time-consuming tasks such as data entry, transaction categorization, and invoice processing. This not only reduces human error but also frees up accountants to focus on more strategic and analytical activities.

- Data Analysis: AI can quickly analyze vast amounts of financial data to identify trends, anomalies, and potential risks. This analytical power allows businesses to make more informed decisions and adjust strategies in real-time.

- Predictive Insights: By analyzing historical data, AI can predict future financial trends and outcomes. This assists businesses in forecasting, budgeting, and planning for various scenarios. With the right manual intervention and guidance, AI can assist productively.

- Enhanced Reporting: AI can generate dynamic and customizable reports that offer deep insights into financial performance. These reports can be tailored to specific stakeholders’ needs, aiding in better communication and decision-making.

- Scalability: AI-driven bookkeeping systems excel in scalability, efficiently managing increasing transaction volumes without the need for proportional human resource expansion. This adaptability ensures cost-effective operations and agility in dynamic markets, freeing businesses to focus on strategic growth.

- Transaction Automation: AI can automatically categorize and record transactions from bank statements, invoices, and receipts, reducing the manual effort required for data entry. With the needed supervision, AI would be able to provide the correct output.

- 24/7 Accessibility: AI-powered systems can operate around the clock, enabling businesses to access up-to-date financial information whenever they need it.

As businesses continue to adopt AI-powered solutions, the role of accountants is shifting from data entry and basic tasks towards strategic analysis and decision-making based on the valuable insights AI can provide.

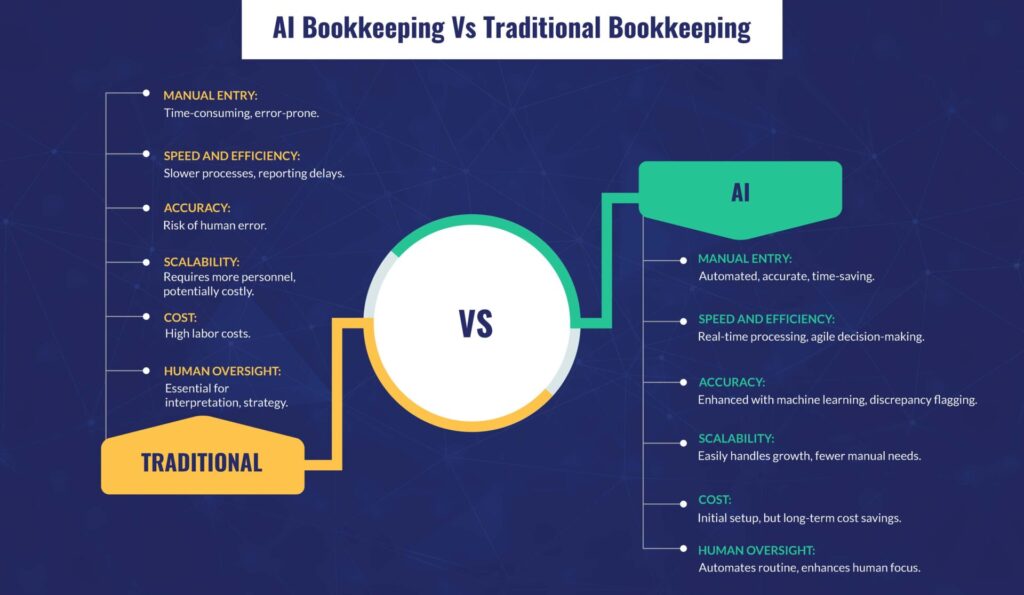

Differences between AI Bookkeeping and Traditional Bookkeeping

AI differs from traditional bookkeeping methods in several significant ways, fundamentally changing how bookkeeping tasks are executed. Here’s a breakdown of the key differences, the specific tasks AI can handle, and the benefits of AI in bookkeeping:

- Manual Data Entry (Traditional Bookkeeping): Traditional bookkeeping involves the manual entry of financial transactions, which is time-consuming and prone to human errors.

Solution with AI Bookkeeping: AI bookkeeping solves this issue by automating data entry using machine learning algorithms. It eliminates the need for manual input, ensuring accuracy and saving time.

- Speed and Efficiency (Traditional Bookkeeping): Traditional bookkeeping processes can be slow, leading to delays in financial reporting and decision-making.

Solution with AI Bookkeeping: AI bookkeeping significantly improves speed and efficiency by processing and analyzing financial data in real-time or near real-time. This allows for quicker decision-making and agile financial management.

- Accuracy (Traditional Bookkeeping): Human error is a common risk in traditional bookkeeping, as manual data entry and calculations can lead to mistakes in financial records.

Solution with AI Bookkeeping: AI systems enhance accuracy by using predefined rules and machine learning models to identify discrepancies and flag potential errors for human review. This reduces the risk of inaccuracies.

- Scalability (Traditional Bookkeeping): Scaling traditional bookkeeping often requires hiring more personnel or outsourcing to additional accounting firms, which can be costly and complex.

Solution with AI Bookkeeping: AI bookkeeping is scalable and can handle larger volumes of data and complex transactions as a business grows, without the need for significant manual intervention. This simplifies scalability and reduces costs.

- Cost (Traditional Bookkeeping): Traditional bookkeeping involves ongoing labor costs, including salaries and benefits for bookkeepers or accountants, which can be expensive.

Solution with AI Bookkeeping: AI bookkeeping may have an initial setup cost but can be cost-effective in the long run by reducing labor expenses. It also helps avoid costly errors that could arise from manual processes.

- Human Oversight (Traditional Bookkeeping): Traditional bookkeeping relies heavily on human expertise for interpreting financial data, making strategic decisions, and addressing unique circumstances.

Solution with AI Bookkeeping: AI bookkeeping complements human oversight by automating routine tasks, allowing professionals to focus on interpreting data, making informed decisions, and handling complex situations effectively.

In summary, traditional bookkeeping involves manual data entry, which is slow and error prone. AI bookkeeping addresses these issues by automating data entry, improving speed, accuracy, scalability, and cost-efficiency, while still benefiting from human oversight for critical decision-making.

Exploring AI-Powered Bookkeeping Tools

a. Bill.com

Bill.com is a widely used AI-powered bookkeeping tool that streamlines and automates various financial processes for businesses.

Features and Capabilities:

- Invoice Management: Bill.com can digitize, categorize, and store invoices electronically, reducing manual data entry.

- Automated Approval Workflows: It enables businesses to create customized approval workflows, automating the process of routing invoices for review and approval.

- Payment Processing: The tool facilitates electronic payments, saving time and reducing the need for paper checks.

- Document Storage: It offers secure cloud-based storage for financial documents, making them easily accessible and organized.

- Integration: Bill.com integrates with accounting software like QuickBooks and Xero, ensuring seamless data synchronization.

Benefits of Integration:

- Efficiency: Automates invoice processing, approval workflows, and payment tasks, reducing manual effort and improving efficiency.

- Accuracy: Minimizes errors associated with manual data entry and ensures accurate record-keeping.

- Time Savings: Reduces time spent on administrative tasks, allowing staff to focus on more strategic activities.

- Cash Flow Management: Helps optimize cash flow by providing insights into upcoming expenses and payments.

b. Hubdoc

Hubdoc is another AI-driven tool designed to streamline document collection and management for accounting and bookkeeping purposes.

Primary Functions and Advantages:

- Document Capture: Hubdoc can automatically fetch financial documents from various sources, such as bank accounts, email, and online portals.

- Data Extraction: It uses OCR (Optical Character Recognition) technology to extract relevant data from documents, like invoices and receipts.

- Organization: Documents are categorized, organized, and stored in a centralized hub for easy access.

- Automation: Hubdoc integrates with accounting software, populating financial data into the appropriate fields automatically.

Real-World Application Scenarios:

- Expense Tracking: Hubdoc can capture receipts and categorize expenses, making it easier to track business expenses.

- Bank Reconciliation: By automatically fetching bank statements and categorizing transactions, it simplifies reconciliation processes.

- Audit Preparation: The organized document repository can simplify the audit process by providing easy access to required documents.

c. Dext

Formerly known as Receipt Bank, Dext is an AI-powered tool designed to digitize and automate bookkeeping tasks.

Capabilities:

- Receipt Digitization: Dext can scan and digitize receipts, invoices, and other financial documents.

- Data Extraction: It extracts key information from documents and inputs it directly into accounting software.

- Coding and Categorization: The tool can intelligently categorize transactions based on historical data.

- Integration: Dext seamlessly integrates with various accounting platforms, enhancing data synchronization.

Value in Modern Accounting:

- Efficiency: Dext automates data entry, reducing the time spent on manual input and increasing efficiency.

- Data Accuracy: Minimizes errors by automating data extraction and categorization.

- Real-Time Insights: Provides real-time visibility into financial transactions, aiding timely decision-making.

d. AutoEntry

AutoEntry is an AI-powered data entry and document management tool aimed at simplifying bookkeeping processes.

Capabilities:

- Data Capture: AutoEntry extracts data from documents such as invoices, receipts, and bills.

- Automated Entry: It populates accounting software with the extracted data, reducing manual data entry.

- Supplier Statements: AutoEntry can process supplier statements, enabling reconciliation with minimal effort.

- Integration: The tool integrates with popular accounting platforms, ensuring seamless data flow.

These AI bookkeeping tools collectively contribute to more efficient, accurate, and streamlined financial management processes, allowing businesses to focus on their core operations and make informed decisions based on real-time data.

Ensuring Seamless Integration of AI Tools:

Integration of AI tools with existing systems requires careful planning.

- Data Compatibility: Ensuring AI tools work seamlessly with current data structures prevents disruptions.

- User Training: Proper training ensures staff can utilize AI tools effectively.

- Regular Audits: Periodic assessments verify that AI outputs align with business goals.

Successfully incorporating AI tools into bookkeeping demands a balance between automation and human oversight, safeguarding data security, preserving the human touch, and facilitating the smooth integration of technology with existing processes.

Transforming the Role of Accountants with AI Bookkeeping

Auto-Entry transforms accountants’ functions from mundane tasks to strategic roles.

- From Manual Data Entry to Strategic Financial Advisory Roles: Accountants shift focus from repetitive manual tasks to offering strategic financial advice.

- Enhancing Client Relationships through Insightful Analytics: Accountants leverage AI insights to provide clients with valuable data-driven advice, strengthening relationships.

- Continuous Learning and Adaptation in the Face of AI Tools: Accountants must embrace the learning curve, continually enhancing their skills to leverage AI’s potential fully.

Challenges and Considerations of AI Bookkeeping

While AI tools like Auto-Entry offer significant advantages, using AI bookkeeping tools have its share of disadvantages, where traditional bookkeeping excels.

- Complex and Unique Transactions: Traditional bookkeepers can use their expertise to handle complex or unique financial transactions that may not fit neatly into predefined AI algorithms. AI may struggle with unusual or non-standard financial scenarios, requiring human intervention.

- Adaptability to Regulatory Changes: Traditional bookkeepers can stay up to date with changing tax laws and regulations and adapt their practices accordingly. AI systems may require updates or retraining to accommodate regulatory changes, which can take time and resources.

- Personalized Financial Advice: Traditional bookkeepers can provide personalized financial advice and strategic insights based on their understanding of a business’s specific goals and challenges. They can offer recommendations beyond data analysis, considering the broader context of the business.

- Data Privacy and Security: Some businesses may have concerns about data privacy and security when using AI-driven bookkeeping systems, especially if sensitive financial information is stored in the cloud. Traditional bookkeeping allows for more direct control over data security.

- Cost of Implementation: While AI bookkeeping can be cost-effective in the long run, the initial setup cost and integration of AI systems can be a barrier for smaller businesses with limited budgets. Traditional bookkeeping may have a lower entry cost.

- Human Touch and Trust: Some businesses value the personal relationships and trust they have with their traditional bookkeepers or accountants. Human interactions can provide reassurance and a sense of partnership that may be lacking with AI systems.

- Ethical Considerations: Accountants must navigate ethical considerations tied to AI’s decision-making processes.

It’s important to note that the choice between traditional and AI bookkeeping often depends on the specific needs, size, and preferences of a business. Many businesses choose to blend these approaches, using AI for routine tasks and relying on human expertise for complex financial decisions and personalized guidance.

Conclusion

AI has revolutionized accounting, enhancing efficiency and accuracy. However, its true potential is realized when combined with human expertise. The synergy between AI’s automation and human understanding creates a powerful force that drives innovation and informed decision-making. In this collaborative landscape, technology and human acumen together shape the future of accounting, optimizing results and ensuring success.

Key Takeways:

- AI-powered tools are reshaping accounting by streamlining processes and improving efficiency.

- The true power lies in the synergy between AI and human expertise, combining technology and human judgment.

- Human oversight remains crucial for error detection, contextual understanding, and ethical decision-making.

- The collaboration between AI and human accountants yields optimal outcomes and informed strategic decisions.

- The future of accounting embraces both technology and human acumen, promising unparalleled accuracy and success.

If you enjoyed reading this article, be sure to explore our other blogs on Accounting, Bookkeeping, and Outsourcing!

Are you ready to streamline your operations? Benefit from time savings, reduced errors, and expert assistance with AcoBloom’s outsourcing Bookkeeping services. Elevate your business with AcoBloom’s tailored solutions and unlock efficiency and accuracy in financial strategies. Contact us now to learn more.