Talking about managing Tax Preparation, a CPA firm will instinctively start thinking of hiring an in-house tax preparer. However, most CPA firms, small to medium-sized, are turning towards outsourced tax preparation services. This is because the major chunk knows the benefits of availing outsourcing of services in the long run.

Even if a CPA firm decides to hire an in-house tax preparer, other factors pose challenges such as remuneration, insurance, other overheads, time & energy consumption etc. A CPA firm which is concerned about its growth needs to outgrow traditional behaviours.

However, it is not easy to break away from old patterns, that’s the reason why some CPAs remain sceptical and indecisive about when to start outsourcing even after knowing all the benefits.

The question arises, when would it be appropriate to take the aid of tax preparation outsourcing services?

Identify the right time to take shelter from an outsourcing services partner!

Look out for these signs –

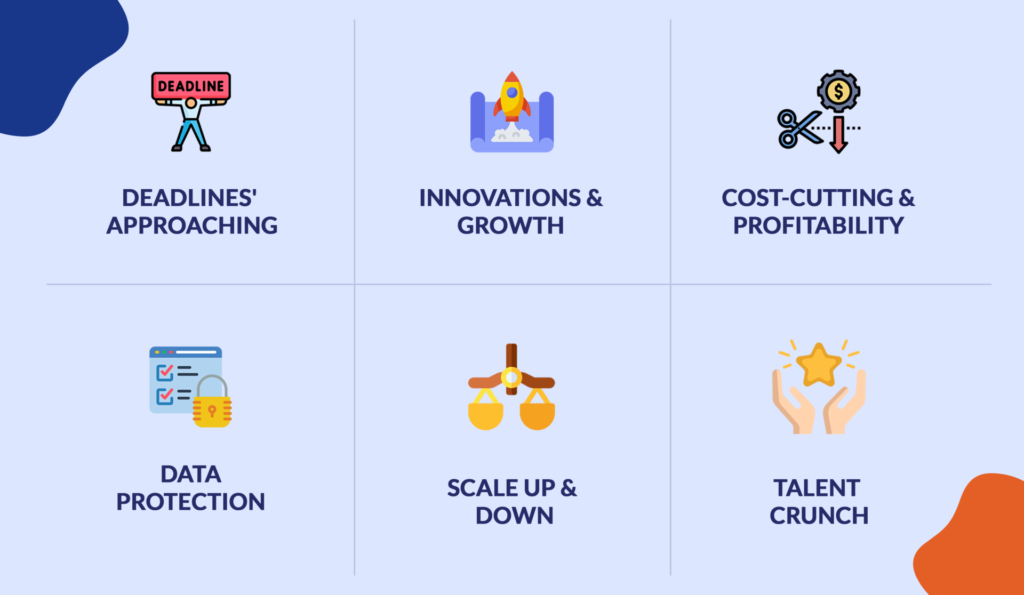

Deadlines’ approaching but you’re still behind

- It has been a while and you have noticed a few instances when the in-house tax preparers have started making errors to hastily complete the tasks just for the sake of it and meet the approaching deadline. You know that you’d need to squeeze out all the work from in-house team members in order to file taxes on time.

Well, it’s time you should outsource. Your outsourcing services partners can execute tax filing on a timely basis with the help of their expert tax preparers and not let you lag behind.

(Note: CPAs need to keep on reminding their clients about the deadlines e.g., for Corporate Tax it is the 15th of March and for Individual Tax 15th of April).

Time to make some Innovations & focus on Growth

Businesses and firms need to take innovative decisions from time to time to ensure a high-soaring growth graph. However, tax preparation eats away most of the time, leaving way too less time to spend on planning growth strategies for the firm.

Realising the above fact, CPAs shall consider delegating the work to the offshore team. With more time at hand, the firms can focus on tax planning (saving), and growth strategies to keep up with other accounting firms.

Cost-cutting & Profitability

The firm would agree on how important it is to cut expenses in order to generate revenue and profitability. However, when the firm is in a dilemma on how to cut costs and increase profitability, outsourcing might be the best option to achieve the same. More than 60% cost savings is possible by taking advantage of offshoring tax preparation services. It will definitely increase your firm’s productivity as the offshore expert team will work as an extended part of your team. You’d be able to save big in the long run.

Data Protection concerns you big time

Well this is something which involves managing highly confidential client information. But with in-house staff preoccupied & stretched thin with all other accounting responsibilities on their shoulders, it somehow becomes challenging to keep errors and fallouts at bay. This becomes another big reason to outsource tax preparation services to a reliable co-sourcing (collaborative outsourcing) partner that can handle the client information with utmost care and keep you in a loop always. Choosing a reliable partner becomes a must for all CPAs whose security policies are of SOC-2 standards issued by the American Institute of Certified Public Accountants (AICPA). CPAs can be at peace with the experts reviewing the work always.

Your firm is either scaling or you want to scale up

The CPAs are proficient in scaling up their work as and when their client’s businesses magnify. This also signifies that outsourcing would be an added advantage, as the tax preparers of outsourcing services partners will carry out tax filing efficiently while the CPAs can enhance professional connections and relations with their clients.

Talent Crunch

It is disturbing to note the sharp decline in ‘skilled’ people in the global workforce. Staff shortages have maxed out the capacities of in-house tax preparers. Over to it the existing employees sometimes go on holidays or get sick, leaving the firms with all the process work to their responsibility. To defy such challenges, outsourcing the tax work wouldn’t hinder, moreover, increase the productivity of the firm. Offshoring teams have got your back, hence, CPAs get the flexibility to pick work anytime and deliver immaculate work in a quick turnaround time.

Final Thoughts

So, how about investing time to create growth strategies for your firm, increase client satisfaction and take the tax preparation work off your shoulders? Sounds profitable! If you can identify even a single such sign, consider delegating your tax preparation requirements to a reliable co-sourcing partner like AcoBloom International.