Our Experience at Glance

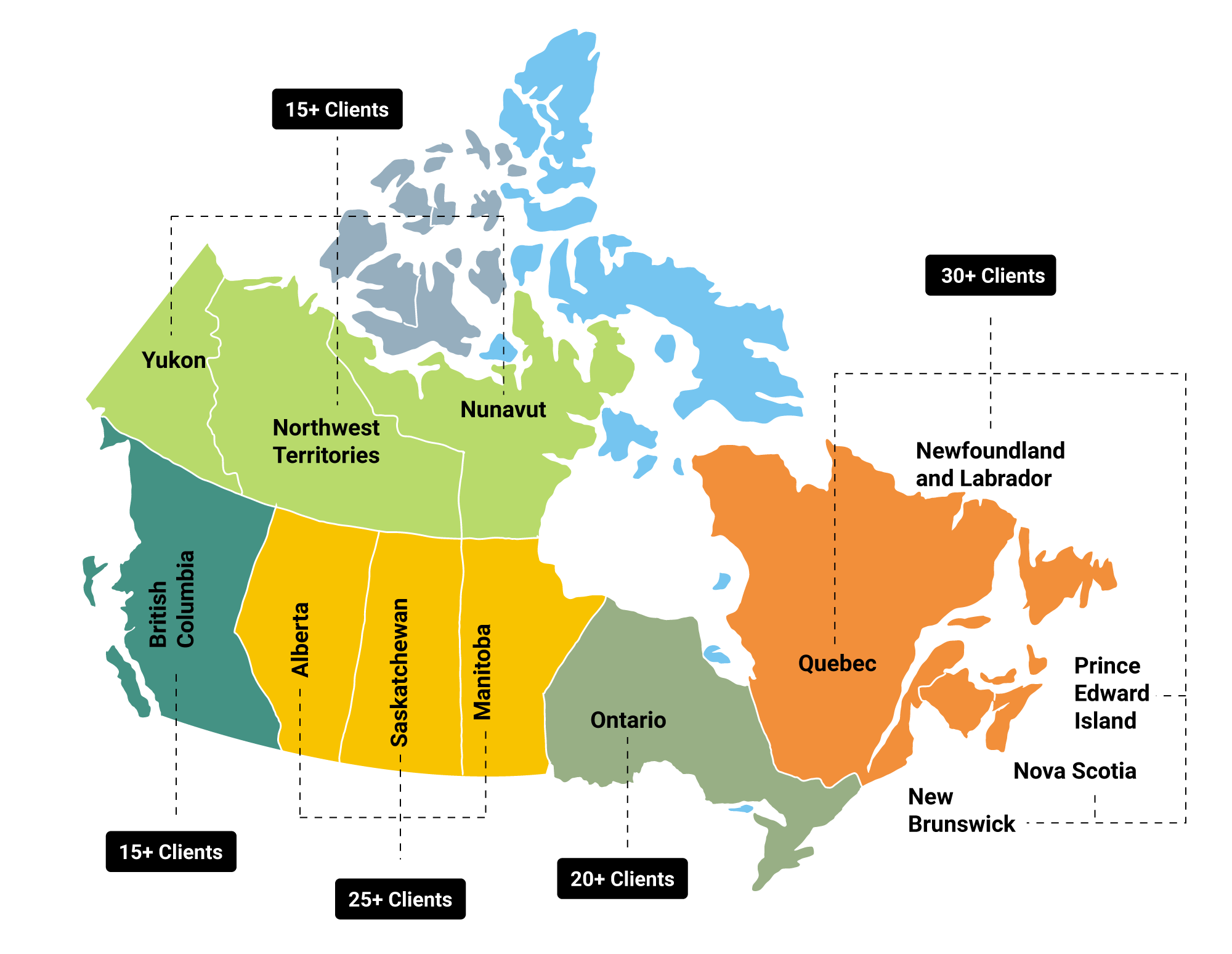

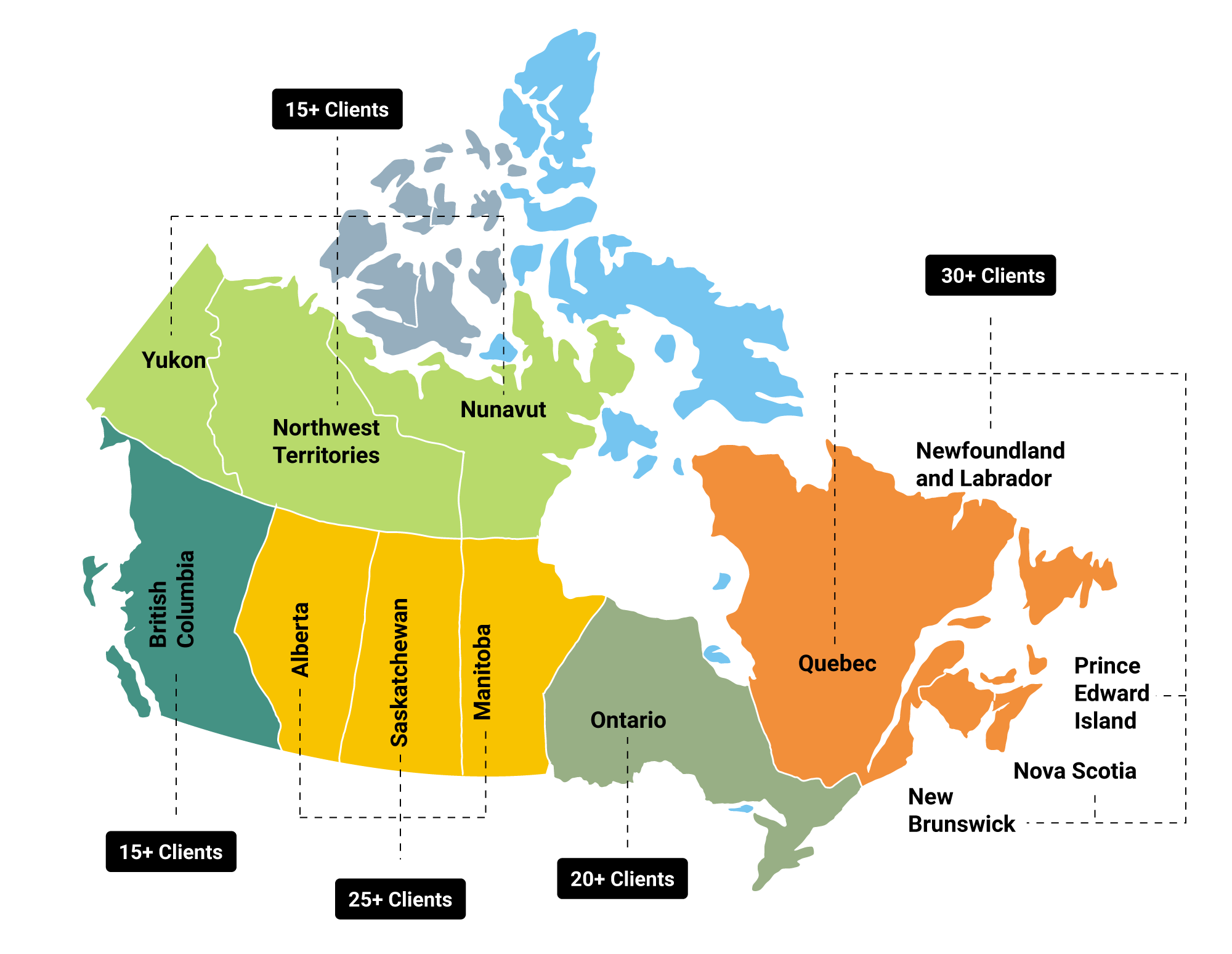

Impactful solutions, fostering growth across Canada.

Years of Experience

CPA/Tax/Accounting Firm Clients

Professionals

Client Retention Rate

Years of Experience

CPA/Tax/Accounting Firm Clients

Professionals

Client Retention Rate

Hire adequate and qualified resources with AcoBloom so that you can alleviate your in-house staff hiring, training and retaining challenges.

Each job or return is reviewed by a manager to ensure accuracy and quality of work so that it’s ready for your sanity check.

We help you in streamlining your workload so that you can focus on better client value proposition and other value-added services.

Here is an estimate comparison of your in-house/local annual cost of a full-time accountant, tax preparer & auditor vs AcoBloom’s professionals.

| Tax Preparer | In House | AcoBloom |

|---|---|---|

| Total Cost | $62,500 | $36,000 |

| In Hand Salary | $55,000 | $36,000 |

| CPP & EI | $3,500 | ✘ |

| Hiring, Training & Retention | $2,500 | ✘ |

| Overheads | $2,500 | ✘ |

| Auditor | In House | AcoBloom |

|---|---|---|

| Total Cost | $85,000 | $46,000 |

| In Hand Salary | $75,000 | $46,000 |

| CPP & EI | $5,000 | ✘ |

| Hiring, Training & Retention | $2,500 | ✘ |

| Overheads | $2,500 | ✘ |

| Accountant | In House | AcoBloom |

|---|---|---|

| Total Cost | $50,000 | $26,000 |

| In Hand Salary | $42,000 | $26,000 |

| CPP & EI | $3,000 | ✘ |

| Hiring, Training & Retention | $2,500 | ✘ |

| Overheads | $2,500 | ✘ |

*Prices may differ depending upon the complexity of various services.

AcoBloom International provides tax, audit, accounting, bookkeeping, and payroll outsourcing services to Canadian tax, CPA, and audit firms. Our solutions have consistently helped firms efficiently delegate operational tasks to our experienced team, allowing them to focus on higher-value activities.

Tax Return Preparation Outsourcing

Audit Support Outsourcing

Bookkeeping Outsourcing

Accounting Outsourcing

Payroll Support Outsourcing

Our team is well-versed with most of the software used in the Canadian accounting industry.

AcoBloom adheres to Privacy Commissioner of Canada (OPC) PIPEDA regulation & stringent international security standards such as ISO 27001, to guarantee the highest level of data security. We implement advanced security measures, including encryption, firewalls, and intrusion detection systems, and conduct regular audits to prevent unauthorized access and data breaches.

Our outsourced tax preparers come with a range of experience levels to match your needs, from those with 2-3 years of experience to seasoned professionals with many years in the field. Additionally, we can provide outsourced tax managers capable of overseeing a team. All of our tax preparers are trained to work independently and do not require micromanagement.

Yes, we provide trials for tax, audit, accounting, and bookkeeping outsourcing services to gauge the quality of our work and evaluate us on various parameters such as turnaround time, communication, review process, etc.

MyCPE is our training partner, and we conduct regular MyCPE training sessions to ensure our team completes the required CPE/CPD hours. Our employees stay updated on key regulations, including OPC guidelines for tax services, Canadian Auditing Standards for audit services, and ASPE and IFRS for accounting services, to maintain compliance and deliver top-quality services.

Yes, you can speak with our team and set up weekly or bi-weekly meetings to discuss workflow, planning, feedback, work allocation, etc.

Yes, we can provide client references from CPA/Accounting, Tax and Audit firms of all sizes (large, mid, and small), with whom you can speak directly to assess us on various parameters such as quality, turnaround time, cost, communication, data security, etc.

No, there are no additional or hidden charges besides the monthly flat fee we charge based on the engagement model you signed up for.

The onboarding process typically takes between 7 to 30 days, depending on the ideal auditor’s availability and the specific skill set required by CPA firm.

No, you do not have to sign a long-term contract and can terminate the services by serving a standard notice period.

Use the form to drop us an e-mail or the Old-fashioned phone calls work too at +1 415 969 7987